Consistency

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Consistency

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss the importance of the consistency principle in accounting. Can anyone tell me what they think 'consistency' means in this context?

Does it mean using the same accounting methods every year?

Exactly! Consistency requires that once a company chooses a certain method—like how it calculates depreciation—it should stick to this method in future reports. This way, stakeholders can effectively compare financial statements over time.

Why is that so important?

Good question! Consistent methods allow investors and creditors to assess trends accurately, making informed decisions. It builds trust in the company's financial reporting.

What happens if a company changes its method?

If a company changes its accounting method, it must disclose this change and explain why. However, frequent changes can lead to confusion and distrust.

How do we remember this concept?

A mnemonic could be "C for Consistency, C for Comparison"—reminding us that consistency allows for better comparison in financial data.

To summarize, consistency in accounting is crucial for trustworthy financial reporting and comparability over time.

Applying the Consistency Principle

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand what consistency is, let’s explore how it applies in real-life scenarios. Can anyone give an example?

If a company starts using the straight-line method for depreciation, it should keep using that method?

Correct! If the company uses the straight-line method in one year, it should continue to use it in subsequent years unless it provides a valid reason for changing it.

What about choosing a method for inventory valuation?

Yes! The choice between FIFO or LIFO should also remain consistent. Changing inventory methods can impact financial results significantly, which is why it's vital to disclose changes.

I see! So if a company doesn’t follow the consistency principle, it can cause issues?

Absolutely! It might mislead investors and result in inefficiencies in the assessment of a business's performance over time.

What’s a good way to reinforce this principle for us?

Consider making a list of all accounting methods and their impacts. This list can serve as a quick reference to remember why we need consistency in accounting practices.

In summary, applying the consistency principle means sticking to chosen accounting methods to ensure the comparability and reliability of financial statements.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The concept of Consistency in accounting emphasizes the importance of using the same accounting principles and methods from year to year without changes. This allows for better comparability of financial statements across periods, aiding stakeholders in making informed decisions.

Detailed

Consistency in Accounting

Consistency is a critical principle in accounting that mandates that once a company selects an accounting method, it should apply this method consistently across all accounting periods. This consistency allows stakeholders—such as investors and regulators—to compare financial statements effectively across different years or periods. If a business were to frequently change its accounting methods, it could mislead stakeholders and distort financial position representation. Thus, adherence to the consistency principle fosters trust, reliability, and comparability, which are vital components of financial transparency in business operations.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Consistency

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Once an accounting method is chosen (e.g., depreciation method), it should be used consistently year after year for comparability.

Detailed Explanation

Consistency in accounting means that once a company selects an accounting method (like a particular way to calculate depreciation), it should continue using that method in subsequent years. This is important because it allows users of financial statements, such as investors and analysts, to easily compare the company's financial performance over time. If a company keeps changing its accounting methods, it becomes very difficult to track how its financial situation changes, making it hard to evaluate its performance accurately.

Examples & Analogies

Think of consistency like following the same recipe every time you bake a cake. If you keep changing the ingredients or the baking time, the cake's taste and texture will vary, making it hard to know if you’re improving or getting worse at baking. Similarly, using the same accounting method allows stakeholders to reliably compare financial statements from one year to the next.

Importance of Consistency

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

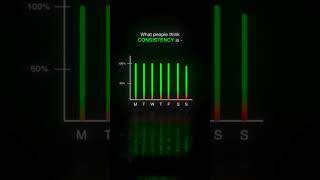

Consistency enables comparability of financial statements over time and across different companies.

Detailed Explanation

When companies use consistent accounting methods, it makes it easier for stakeholders to compare financial statements, both over different periods and against other companies in the same industry. This comparability is critical for investors who are making decisions about where to allocate their funds. If two companies use different methods to report their financials, it undermines one's ability to understand which company is financially healthier or performing better overall.

Examples & Analogies

Imagine you are comparing two athletes' performances in a sport. If one athlete runs a 100m race in two different styles of shoes each time while the other uses the same type of shoes consistently, it could affect their speed and performance. To accurately compare their running times, it’s essential that both use the same shoes. Similarly, consistent accounting practices allow for fair comparisons of financial performance.

Consequences of Inconsistency

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Inconsistent application of accounting methods can lead to misleading financial statements and loss of trust from stakeholders.

Detailed Explanation

If a company frequently changes its accounting methods, stakeholders may become confused and distrustful of its financial reports. For example, if one year a company uses a straight-line method of depreciation and the next year it switches to an accelerated method, it can make profits appear inflated or deflated unpredictably. This can mislead investors and analysts, ultimately hurting the company's reputation and potentially affecting its stock price.

Examples & Analogies

Consider a student who changes their studying method from year to year—one year they study by reading notes, the next year by watching videos, and the following year by doing practice tests. Their grades would vary not just because of their understanding of the material but due to the inconsistency of their study methods. In the same way, inconsistent accounting practices can mislead stakeholders about a company's true financial health.

Key Concepts

-

Consistency Principle: An accounting principle that promotes using the same methods across periods.

-

Comparability: Allows stakeholders to compare financial statements over time.

Examples & Applications

If a company uses the straight-line method for depreciation in one year, it should continue with this method unless there's a valid reason to switch.

If a retail business initially used FIFO for inventory valuation, it should consistently use FIFO to allow for comparable financial results.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Consistency’s like your favorite song, play it the same way, you can’t go wrong!

Stories

Once there was a baker, Bob, who made bread. He used the same recipe every day, so everyone came back for more. But when Bob changed it every week, people got confused and stopped visiting his shop. This shows how important consistency is!

Memory Tools

C for Consistency, C for Comparison – remember that consistent methods help in making sound comparisons.

Acronyms

C.P. = Consistency Principle; Always stick to your chosen methods to keep the data true.

Flash Cards

Glossary

- Consistency Principle

A fundamental accounting principle that requires a company to use the same accounting methods and principles across successive periods for comparability.

Reference links

Supplementary resources to enhance your learning experience.