Materiality

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Materiality

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we're going to discuss materiality in accounting. Does anyone know what materiality refers to?

Isn't it about how significant information is in financial statements?

Exactly! Materiality is about determining which information is significant enough to impact decisions. We emphasize relevant information to aid stakeholders. This streamlines our reports.

So, does that mean small transactions can be ignored?

Yes, smaller and less significant transactions may be grouped or omitted, as they do not materially affect the overall financial position. Remember, 'If it doesn't influence decisions, it might not need disclosure.'

How do we decide what's material?

Good question! We assess whether the omitted information could change a user's decision regarding the financial statements. Think about it like prioritizing email updates; you focus on vital messages first.

Got it! It’s like separating important news from gossip.

Exactly! Let’s summarize: Materiality helps us focus on critical financial data while excluding immaterial details. It enhances clarity in financial reporting.

Application of the Materiality Principle

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

How do we apply materiality when preparing financial reports? Anyone want to share their thoughts?

Maybe we could categorize expenses to see which ones to report individually?

Right! For instance, grouping minor expenses can help streamline reports, as showing every small detail may confuse the reader.

Are there official guidelines for deciding materiality?

Yes! Generally Accepted Accounting Principles (GAAP) provide frameworks, but companies often set their thresholds. For instance, a percentage of net income is commonly used.

That sounds practical! Can you give an example?

Sure! If a company has a net income of ₹10,00,000, it might set its materiality threshold at 5%. Therefore, any transaction below ₹50,000 can be deemed immaterial.

This definitely helps in focusing on what matters most.

Exactly! Always keep in mind: 'not all information is created equal.' Materiality is about striking the right balance.

Materiality in Technology and Software Design

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss how the principle of materiality informs software design for accounting applications. How do you think it helps?

It probably helps create user-friendly reports that focus on what's important.

That's right! By understanding materiality, developers can prioritize significant data in their products. This improves user experience.

What if a software developer neglects materiality?

If they neglect materiality, they risk overwhelming users with irrelevant data, making it hard to make decisions. Hence, software design must reflect materiality principles.

So, is there any specific technology consideration?

Absolutely! An example is ensuring that reports can filter out immaterial transactions, allowing users to receive targeted insights quickly.

I've learned that exact data focus is crucial for effective decision-making.

Right! Remember, embedded materiality helps both accountants and developers frame better financial narratives.

The Importance of Materiality in Reporting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s conclude by discussing why materiality is vital in financial reporting. Who wants to chime in?

It definitely helps avoid information overload!

Exactly! Materiality allows stakeholders to focus on what truly matters, reducing cognitive load.

Could it also affect decision-making outcomes?

Absolutely! By presenting relevant information, decisions are based on accurate analyses, leading to better outcomes.

Are there risks in not applying materiality effectively?

Definitely! Poor application of materiality can lead to misleading reports and potentially result in non-compliance with regulations.

So it’s really about transparency and accuracy then?

You got it! Materiality is the cornerstone of effective financial communication, ensuring transparency and fostering trust in the financial information presented.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

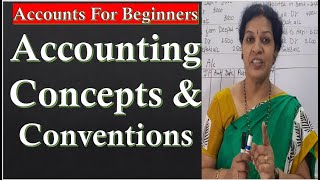

In accounting, the concept of materiality stresses that only significant information that could influence economic decisions needs to be presented in financial reports. This helps in prioritizing information that truly matters to stakeholders, while less important details can be omitted for clarity and efficiency.

Detailed

Materiality in Accounting

Materiality is a fundamental accounting principle that dictates that only information which could affect a stakeholder’s decision should be disclosed in financial statements. Materiality serves as a filter; it helps in determining which information is relevant and which can be omitted to avoid clutter in financial reporting.

For instance, small expenses or transactions that do not significantly affect a company’s financial position can often be grouped or omitted. This ensures that the focus remains on the information that could influence decision-making. The principle of materiality is crucial for effective communication of financial data, as it helps streamline information, leading to better understanding among investors, management, and other stakeholders.

Recognizing that not all details carry the same weight, entities must evaluate the potential impact of omitted information on the users of their financial reports. Thus, materiality not only enhances clarity but also ensures regulatory compliance by adhering to generally accepted accounting principles (GAAP). In the context of technology, especially for software developers, materiality informs designs of accounting systems to highlight substantial details while managing less impactful information.

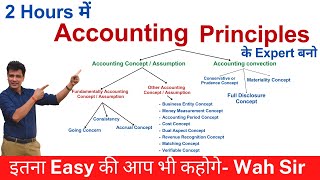

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Significance of Materiality

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Only significant information that could influence decision-making needs to be disclosed.

Detailed Explanation

The concept of materiality in accounting states that not all information requires equal emphasis. Instead, focus should be placed on information that is significant enough to impact decisions made by users of financial statements. This means that if something is not likely to influence a decision, it may not need to be reported in detail. The goal is efficient communication with stakeholders without overwhelming them with unnecessary details.

Examples & Analogies

Think of materiality like packing for a trip. You only pack essential items – such as clothes and toiletries – because they are significant for your journey. Packing unnecessary items, like a thousand paperclips, would clutter your suitcase and make it harder to find what you actually need. Similarly, in accounting, irrelevant transactions (like a minimal office supply purchase) can be omitted for clarity.

Grouping of Immaterial Transactions

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Small, immaterial transactions may be grouped or omitted from detailed reporting.

Detailed Explanation

When financial transactions are deemed immaterial – meaning they do not significantly affect the overall financial picture – they can be grouped together or omitted entirely from the financial reports. This practice simplifies reporting and ensures that stakeholders focus on more impactful transactions, thus maintaining the clarity and relevance of financial documents. The threshold for what is considered immaterial can vary by organization and industry.

Examples & Analogies

Imagine a restaurant that serves many small costs like napkins and straws. Individually, these costs are negligible, and accounting for them one by one would clutter financial records. Instead, the restaurant could lump these small costs into one category called 'office supplies.' Just like how a casserole combines many ingredients into one dish for easier serving, grouping immaterial transactions helps streamline financial statements.

Key Concepts

-

Materiality: The principle that emphasizes disclosing only significant information in financial reporting.

-

Stakeholders: Individuals or groups with an interest in the organization's financial results.

-

Disclosure: Making financial information available to users, particularly stakeholders.

-

GAAP: A collection of accounting rules and standards guiding the preparation of financial statements.

Examples & Applications

A company with a net income of ₹5,00,000 sets a materiality threshold of 5%, meaning transactions below ₹25,000 can be grouped and not separately disclosed.

In a financial statement, a company might disclose significant operational losses but not mention insignificant expenses such as office supplies.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When it’s big, let it show, small stuff can go, materiality’s the way to know!

Stories

Once, there was a company that disclosed every small detail in their financial reports, but the stakeholders were confused. They realized materiality helped share only the significant news, leading to better decisions!

Memory Tools

Mighty Elephants Let Big Achievements Show (Materiality = Exclude Little Bits Affecting Overall).

Acronyms

M.I.N.E. (Materiality Impacts Necessary Exclusions).

Flash Cards

Glossary

- Materiality

The principle in accounting that stipulates only significant information that could influence decisions should be disclosed in financial reporting.

- Stakeholders

Individuals or groups that have an interest in the financial performance of a business, such as investors, creditors, and management.

- Disclosure

The action of making new or secret information known, especially in the financial context.

- GAAP

Generally Accepted Accounting Principles, a framework of accounting standards and guidelines used in financial reporting.

Reference links

Supplementary resources to enhance your learning experience.