Accrual Concept

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to the Accrual Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we’re diving into the Accrual Concept. Can someone explain what accrual means in the context of accounting?

It means that we record revenues and expenses when they are earned or incurred.

Exactly! This concept is crucial. What happens if we only use cash basis accounting instead?

That could misrepresent how well the business is doing, right? It might show lower profits if cash isn't received yet.

Great point! Remember, the accrual concept allows us to record when the transaction occurs, thus giving a clearer picture of financial performance.

Examples of Accrual Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

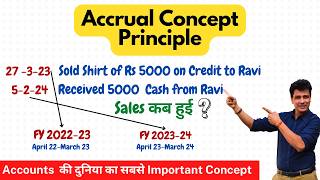

Let’s look at some examples. If a company completes a project in March but receives payment in April, how do we record that?

We would record the revenue in March because that's when the work was completed.

Correct! Now, what about expenses? If a company incurs expenses for services in March but pays in April?

We still recognize the expense in March, right? Even if the cash flows out later.

Yes, that’s right! This consistency is key in accrual accounting, ensuring that financial statements are accurate.

Accrual Concept vs. Cash Basis Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s compare the accrual concept with cash basis accounting again for clarity. Student_1, what’s the main difference?

The accrual concept records transactions when they occur while cash basis records only when cash changes hands.

Absolutely! Why do you think this is important for a business's financial analysis?

Because it gives a better picture of ongoing operations rather than just cash flow, which could be misleading.

Exactly! Understanding this concept helps businesses make better financial decisions. It's crucial for stakeholders.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Accrual Concept emphasizes that financial transactions should be recorded when they occur, rather than when cash is exchanged. This principle is crucial for accurate financial reporting, allowing companies to provide stakeholders with a clearer picture of their financial performance during a specific accounting period.

Detailed

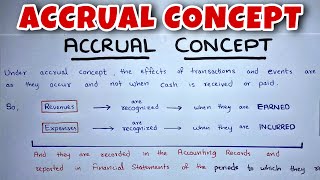

Accrual Concept

The Accrual Concept is a fundamental principle in accounting, which stipulates that revenues are recognized when they are earned, and expenses are recognized when they are incurred, regardless of when cash is exchanged. This concept contrasts sharply with the cash basis of accounting, where transactions are recorded only when cash changes hands.

Key Aspects:

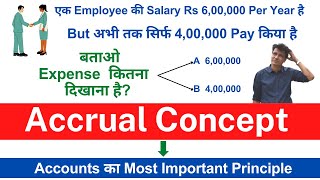

- Timing of Recognition: Under the accrual concept, the timing of recognition of expenses and revenues is crucial. For instance, if a service is provided in March, the revenue is recognized in March, even if payment is received later. Similarly, if an expense is incurred in March, such as paying for services rendered, it should be recorded in March, even if the payment is made in April.

- Financial Statements Impact: This principle ensures that financial statements reflect the true financial position of a company within a given period. By recording all earned revenues and incurred expenses, stakeholders can assess company performance accurately since the financial statements, such as income statements, will show all the activities of that period.

- Stakeholder Trust: By adhering to the accrual concept, organizations enhance transparency and reliability in their financial reporting, gaining the trust of investors, creditors, and regulators.

The accrual concept is considered essential in the preparation of accurate financial reports and helps facilitate better financial analysis.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of the Accrual Concept

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Revenues and expenses are recorded when they are earned or incurred, not when cash is exchanged.

Detailed Explanation

The accrual concept is fundamental in accounting. It differs from the cash basis of accounting, where transactions are recorded only when cash is actually received or paid. Under the accrual concept, the recognition of revenues and expenses takes precedence over cash transactions. This means that, rather than waiting for cash to change hands, businesses record revenue when they deliver goods or services and expenses when they are billed, regardless of when the payment is made.

Examples & Analogies

Imagine you run a small contractor business. You finish a house renovation in March and send the invoice for ₹50,000. Although you receive the payment in April, under the accrual concept, you still record the ₹50,000 as revenue in March, the month you completed the renovation. This practice gives a more accurate picture of your business's financial situation and performance for that specific period.

Cash Basis vs. Accrual Basis

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Opposite of the cash basis of accounting.

Detailed Explanation

The cash basis of accounting records revenues and expenses at the moment cash changes hands. In contrast, the accrual basis emphasizes the timing of the actual earning of revenue and incurring of expenses. This difference can significantly affect financial statements, as cash basis does not show all liabilities or income that is due but not yet collected. Therefore, the accrual basis is more aligned with the true economic transactions of a business.

Examples & Analogies

Consider a freelance graphic designer. Using the cash basis, they only record income when they are paid for a project. But if they complete a project and issue an invoice in September, but don't receive payment until October, their earnings for September would appear lower than they actually are. By using the accrual basis, they would record that income in September, reflecting their business's real performance.

Importance of the Accrual Concept

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The accrual concept leads to a more accurate representation of financial performance over a specific period.

Detailed Explanation

By adhering to the accrual concept, businesses can match revenues with expenses related to generating those revenues within the same accounting period. This matching principle ensures that financial statements present a clearer view of profitability and operational efficiency. It allows stakeholders, including investors, creditors, and management, to assess the business's performance more accurately, which can be crucial for decision-making.

Examples & Analogies

Think of how you track your monthly expenses. If you subscribe to a streaming service and pay your fee at the beginning of the month, the service is provided for the entire month, not just when you paid. By using the accrual accounting principle, you acknowledge the expense each month as you use the service, giving you a realistic view of your monthly entertainment costs.

Key Concepts

-

Accrual Concept: Records revenues and expenses when earned or incurred.

-

Cash Basis Accounting: Records transactions only when cash is exchanged.

-

Financial Statements: Reports outlining the financial performance of a business.

Examples & Applications

A company completes a service in March but receives payment in April; revenue is recorded in March.

A company incurs an expense for utilities in March but pays the bill in April; the expense is recorded in March.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Accrue your dues, it’s what you should do, recognize income, it’s true!

Stories

A consultant named Alex finishes a project in March but waits for cash in April. Understanding the Accrual Concept, he records the revenue in March to reflect true earnings.

Memory Tools

EARN: Expenses Acknowledge, Revenues Noted at realization date.

Acronyms

CARE

Cash Accounting Recognizes cash

while Earns are recorded in the Accrual method.

Flash Cards

Glossary

- Accrual Concept

An accounting principle that records revenues and expenses when they are earned or incurred, rather than when cash is exchanged.

- Cash Basis Accounting

An accounting method that records revenues and expenses only when cash is received or paid.

- Financial Statements

Formal records of the financial activities and position of a business, person, or entity.

- Revenue Recognition

The accounting principle that determines the specific conditions under which income becomes recognized as revenue.

Reference links

Supplementary resources to enhance your learning experience.