Matching Concept

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to the Matching Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are discussing the Matching Concept, a key principle in accounting. Can anyone tell me what you think it refers to?

Is it about matching expenses to revenues?

Exactly! The Matching Concept is all about recording expenses in the same period as the revenues they help generate. Why do you think this is important?

It makes financial statements more accurate, right?

Correct! This alignment improves the reliability of profit calculations and helps stakeholders assess the company’s performance accurately. It's essential for providing a clear picture of financial health.

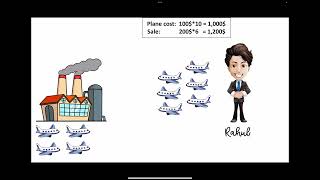

Practical Example of the Matching Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s look at an example. If a company earns ₹1,00,000 in revenue in March but pays a commission of ₹10,000 in April, how should this be recorded?

The ₹10,000 commission should be recorded in March, right?

Yes! That’s the essence of the Matching Concept. We record the expenses in the same month as the revenues they relate to, which gives a clearer picture of profit for that period.

What happens if we don’t follow this concept?

Good question! Ignoring the Matching Concept can lead to overstated or understated profits, creating an inaccurate financial picture and potentially misleading stakeholders.

Importance of the Matching Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Why do you think the Matching Concept is a critical part of preparing financial statements?

It helps in making sure profits are not misleading?

Exactly! It ensures that financial statements provide a true reflection of a company's operations over time. Who can summarize its benefits?

It improves accuracy, enhances transparency, and boosts trust from investors and creditors.

Well summarized! This concept is foundational for any business looking to disclose financial information transparently.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Matching Concept states that expenses should be recorded in the same period as the revenues they generate. This principle is crucial for accurate financial reporting and ensuring stakeholders can evaluate a company's performance effectively.

Detailed

Detailed Summary

The Matching Concept is a fundamental accounting principle that requires businesses to record expenses in the same accounting period as the revenues they help to generate. This concept ensures that financial statements accurately reflect a company's performance within a specific timeframe. For instance, if a business earns revenue from sales in March but pays associated expenses, like commissions, in April, it is crucial to recognize those expenses in March alongside the recorded revenue. This principle helps prevent misleading financial reporting and enhances the accuracy of profit calculations, as it correlates income to the expenses incurred in generating that income. Such alignment is vital for stakeholders, including investors and management, who depend on financial statements to make informed decisions.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Practical Application of the Matching Concept

Chapter 1 of 1

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Example: If you earn revenue in March but pay commission in April, it should still be recorded in March.

Detailed Explanation

This example illustrates how the Matching Concept is applied in practice. By recording the commission expense in March when the revenue was earned, it accurately reflects the financial activities of the business in that month. This provides a clearer picture of profit or loss for that period, which is critical for making informed financial decisions.

Examples & Analogies

Imagine you are a freelance graphic designer. You complete a project in December and send an invoice for ₹20,000, which is paid in January. However, if you have to pay a subcontractor ₹5,000 for their work on that project in December, you would record that expense in December as well. This practice allows you to see how much profit you made from that project right at the end of the year, rather than having the expense show up in the next year, which would distort your financial results.

Key Concepts

-

Matching Concept: Aligns expenses to revenues in the same period to provide accurate financial reports.

-

Revenue Recognition: Governs when and how revenues are recorded.

Examples & Applications

Company A earns ₹50,000 in sales in a month and pays ₹5,000 for advertising in the same month; the expense is matched with income.

Company B provides services worth ₹30,000 in January but pays related costs in February; according to the Matching Concept, the costs must be recognized in January.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In March, the cash can flash, but where's the expense? Match it fast, avoid the tense.

Stories

Imagine Alex running a bakery, he sells cakes in October but pays for ingredients in November. If he records the ingredient costs in October, it tells a true tale of his earnings—matching expenses makes his cake business sweeter!

Memory Tools

M.A.T.C.H: Match All Transactions with Corresponding Holdings.

Acronyms

M.S.E. - Matching ensures proper Statement Equity.

Flash Cards

Glossary

- Matching Concept

An accounting principle that requires expenses to be recorded in the same period as the revenues they help generate.

- Revenue Recognition

A principle that dictates when revenue is officially recognized in the financial statements.

Reference links

Supplementary resources to enhance your learning experience.