Format of Balance Sheet

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Balance Sheet

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, everyone! Today, we're going to discuss the Balance Sheet, which is a critical financial statement. Can anyone tell me why it's important?

Is it to show the company's financial position?

Exactly! It helps stakeholders understand the resources and obligations of the business. Now, what are the key sections in a Balance Sheet?

Assets and liabilities, right?

Yes, assets, liabilities, and owner's equity. Remember the acronym ALOE: Assets = Liabilities + Owner's Equity! This will help you remember the essential equation of the Balance Sheet.

Components of Balance Sheet

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know the sections, let's explore each component. What falls under assets?

Fixed assets and current assets?

Correct! Fixed assets may include land and machinery, whereas current assets include cash and debtors. Can anyone give me an example of liabilities?

I think loans and outstanding expenses are liabilities.

Great! Liabilities show what the business owes. Always remember, assets provide value while liabilities indicate obligations.

Understanding Owner's Equity

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's delve into owner's equity. What does this section represent?

It shows the owner's claim on the company's assets?

Correct! So how do we calculate owner's equity?

By subtracting liabilities from assets?

Exactly! It’s a crucial metric for analyzing the net worth of a business. You can use the mnemonic 'OLE,' which stands for Owner's Equity = Assets - Liabilities.

Format of the Balance Sheet

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we covered components, let's look at the format. Why do we organize the Balance Sheet this way?

To easily compare assets with liabilities?

Yes, using a structured format allows clearer insights into the financial standing. What happens if the totals of assets and liabilities don't match?

It means there's an error somewhere in the accounts?

Right! The Balance Sheet must always balance. Remember, 'Total Assets = Total Liabilities + Total Equity.'

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Balance Sheet serves a crucial role in financial reporting by detailing a company's resources (assets) and obligations (liabilities) along with the owner's claim (equity). This structured format follows key accounting principles, ensuring a comprehensive view of the business's financial health.

Detailed

Format of Balance Sheet

The Balance Sheet is a vital financial statement that provides a snapshot of a company's financial position at a specific date. It consists of three main components: assets, liabilities, and owner's equity (capital). This format allows stakeholders to assess the financial soundness and operational efficiency of a business effectively.

Key Components of Balance Sheet

- Assets: The resources owned by the business, which can be classified into fixed assets (like property and machinery) and current assets (like cash and debtors).

- Liabilities: Obligations owed to external parties, including loans, creditors, and outstanding expenses.

- Owner's Equity (Capital): The owner's claim on the company's assets as a result of their investments.

Basic Format of a Balance Sheet

| Liabilities | Amount (₹) | Assets | Amount (₹) |

|---|---|---|---|

| Capital | xxxxx | Fixed Assets | xxxxx |

| Add: Net Profit | xxxxx | – Land & Building | xxxxx |

| Less: Drawings | (xxxxx) | – Plant & Machinery | xxxxx |

| Loan (Long-term) | xxxxx | – Furniture | xxxxx |

| Creditors | xxxxx | Current Assets | |

| Outstanding Expenses | xxxxx | – Cash | xxxxx |

| Bills Payable | xxxxx | – Bank Balance | xxxxx |

| – Debtors | xxxxx | ||

| – Closing Stock | xxxxx | ||

| Total | xxxxx | Total | xxxxx |

Key Principles

- Assets = Liabilities + Capital: This fundamental equation reflects the dual aspect of accounting, reinforcing the balance sheet's purpose.

- The preparation must adhere to accounting principles such as Going Concern, Matching, and Dual Aspect for accurate representation.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Purpose of the Balance Sheet

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To present the financial position of the business at a specific date.

Detailed Explanation

The primary purpose of the Balance Sheet is to provide a snapshot of a company's financial status on a particular date. It answers two main questions: what does the company own (assets), and what does it owe (liabilities). This snapshot helps stakeholders understand whether the business is financially healthy or if it has debts that exceed its assets.

Examples & Analogies

Think of the Balance Sheet like a personal finance statement. Just as you would list all your assets (like your car, house, and savings) alongside any debts (like a mortgage or credit card debt) to understand your financial situation, a Balance Sheet does the same for a business.

Components of the Balance Sheet

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Assets: Resources owned by the business.

- Liabilities: Obligations owed to outsiders.

- Owner’s Equity (Capital): Owner’s claim on business assets.

Detailed Explanation

A Balance Sheet consists of three main components:

1. Assets are everything the business owns. This can include cash, real estate, inventory, and equipment.

2. Liabilities represent what the business owes, such as loans or outstanding payments.

3. Owner's Equity, also referred to as capital, is the remaining value that investors or owners have in the business after all liabilities have been settled. It represents the owner's stake in the company.

Examples & Analogies

You can compare the components of a Balance Sheet to a balance scale. On one side, you have all your assets (the things you own), and on the other side, you balance it with your liabilities (what you owe). The equity reflects what you actually own after all debts are cleared, just like the net worth in your personal finances.

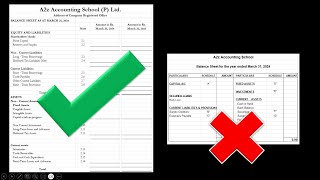

Format of the Balance Sheet

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Liabilities Amount (₹) Assets Amount (₹)

Capital xxxxx Fixed Assets xxxxx

Add: Net Profit xxxxx – Land & xxxxx

Building

Less: Drawings (xxxxx) – Plant & xxxxx

Machinery

Loan (Long- xxxxx – Furniture xxxxx

term)

Creditors xxxxx Current Assets

Outstanding xxxxx – Cash xxxxx

Expenses

Bills Payable xxxxx – Bank Balance xxxxx

– Debtors xxxxx

– Closing Stock xxxxx

Total xxxxx Total xxxxx

Detailed Explanation

The Balance Sheet is structured as a table displaying both liabilities and assets. On the left side, you will find Liabilities, which is further divided into: Capital, Net Profit, Drawings, Long-term Loans, and current obligations like creditors and outstanding expenses. On the right side, you will find Assets, composed of Fixed Assets (like land and machinery) and Current Assets (like cash and stock). This format allows for a quick comparison of what a business owes versus what it owns.

Examples & Analogies

Imagine the Balance Sheet format as a detailed list for a student. On one side, the student lists all the money they owe (like a school loan, credit for supplies) while on the other side, they list their savings (like a bank account balance and the value of a laptop). This way, it’s clear how much cash they have vs. how much they need to pay back.

Key Principles of the Balance Sheet

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Assets = Liabilities + Capital

• Must follow the Going Concern, Matching, and Dual Aspect principles.

Detailed Explanation

The Balance Sheet is built on fundamental accounting principles. The most critical principle is that the total assets must equal the sum of liabilities and capital (equity). This balance ensures that every resource owned by the business is financed either through debt (liabilities) or by its owners (capital). Additionally, the Going Concern principle assumes that the business will continue operating in the foreseeable future, the Matching principle states that expenses should correspond with revenues in the same period, and the Dual Aspect principle maintains that every transaction affects both an asset and a claim.

Examples & Analogies

Think of it like balancing your checkbook. If you receive income (like a payday), it increases your assets (cash) while also affecting your equity (what you have available to spend). Following these principles ensures that you accurately reflect your financial situation, similar to how tidy record-keeping helps manage personal finances.

Key Concepts

-

Assets: Resources owned by a business.

-

Liabilities: Obligations owed to outsiders.

-

Owner's Equity: The owner's claim on the business's assets.

-

Balance Sheet: A summary of assets, liabilities, and owner’s equity at a specific time.

Examples & Applications

A Balance Sheet shows that a company owns ₹500,000 in assets, has ₹300,000 in liabilities, which means it has ₹200,000 in owner's equity.

A company with ₹1,000,000 in assets and ₹400,000 in liabilities will report ₹600,000 as owner's equity.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When you account for assets and loans galore, remember equity's the owner’s core.

Stories

Imagine a baker with a delicious cake (assets). He has to pay his suppliers (liabilities) but whatever is left belongs to him (owner's equity).

Memory Tools

Remember ALOE: Assets = Liabilities + Owner's Equity, to keep the Balance Sheet in sight!

Acronyms

Use the acronym 'BAL' - Balance (equation), Assets, Liabilities to remember the Balance Sheet's core.

Flash Cards

Glossary

- Assets

Resources owned by a business, including fixed and current assets.

- Liabilities

Obligations or debts owed to outsiders.

- Owner's Equity

The owner's claim on the business assets, equal to assets minus liabilities.

- Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and owner's equity at a specific point in time.

Reference links

Supplementary resources to enhance your learning experience.