Format of Trading Account

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Purpose of the Trading Account

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, everyone! Today we're going to learn about the Trading Account. Its main purpose is to determine whether a business made a gross profit or gross loss during a specific period. Can anyone tell me why this is important?

I think it's important because it shows how well a business is performing in selling its products.

Exactly! Evaluating gross profit helps in assessing the operational efficiency of the business. Now, what do you think is included in the Trading Account?

I believe it includes sales and purchases.

Right! Sales and purchases are two critical components. Let’s also remember direct expenses like wages and freight. Can anyone recall why we call these 'direct' expenses?

Because they directly relate to the production and sale of goods!

Spot on! Let’s summarize: the Trading Account helps us analyze sales against costs directly incurred. Very important for evaluating performance.

Components of the Trading Account

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand the purpose, let’s break down the components of the Trading Account. What do we start with?

Opening stock!

Correct! Next, we have purchases. Can someone explain how we adjust for returns?

We subtract purchase returns from total purchases.

Exactly! And what happens at the end of the period?

We account for closing stock.

Right! Now, can you all remember the formula for calculating Gross Profit?

Gross Profit equals Net Sales minus all the costs mentioned.

Perfect! Remembering the structure and calculation will help in interpreting results.

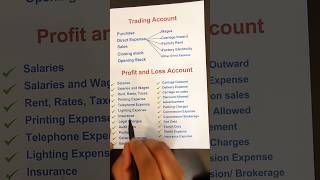

Format of the Trading Account

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's look at the actual format of the Trading Account. I want you to visualize how it is laid out. Who can describe the main sections?

It has a debit side for opening stock, purchases, and expenses, and a credit side for sales.

Exactly! Also, don’t forget that we have to mention returns on both sides. Why do we do this?

To present accurate transactions related to sales and purchases.

Good observation! At the bottom, we calculate either Gross Profit or Gross Loss. How do we figure out which one it is?

By comparing the total debit and credit amounts.

Exactly! Always remember that understanding the format leads to clearer financial insights.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section outlines the structure and purpose of a Trading Account, which aims to determine the gross profit or gross loss of a business. It includes the necessary components such as opening stock, purchases, sales, direct expenses, and closing stock in its format.

Detailed

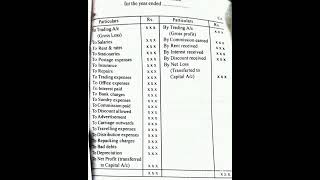

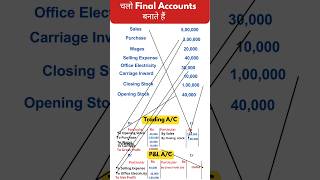

Format of Trading Account

The Trading Account serves a critical purpose in financial accounting, specifically for determining the gross profit or gross loss that occurs during an accounting period. This section outlines its structure in a detailed format:

Structure of Trading Account

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Basic Structure of the Trading Account

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Dr. (Debit) Amount (₹) Cr. (Credit) Amount (₹)

Opening Stock xxxxx Sales xxxxx

Purchases xxxxx Less: Sales (xxxxx)

Returns

Less: Purchase (xxxxx) Closing Stock xxxxx

Returns

Direct

Expenses:

– Wages xxxxx

– Carriage xxxxx

Inward

– Freight xxxxx

– Fuel/Power xxxxx

Gross Profit xxxxx (If debit > xxxxx (c/d) credit: Gross Loss)

Total xxxxx Total xxxxx

Detailed Explanation

The Trading Account structure is presented in a table format with 'Debit' (Dr) and 'Credit' (Cr) columns. The debit side includes 'Opening Stock', 'Purchases', and 'Direct Expenses' directly related to production. The credit side is primarily about 'Sales', with deductions for sales returns. The difference between total debits and total credits determines the 'Gross Profit' or 'Gross Loss' for the period.

Examples & Analogies

Think of the Trading Account like a business report card for the production aspect of a company. Just as a student's final grades reflect their performance over a semester, the Trading Account summarizes how well a business has performed in terms of buying, selling, and producing goods.

Calculating Gross Profit or Loss

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Gross Profit = Net Sales – (Opening Stock + Purchases – Purchase Returns + Direct Expenses – Closing Stock)

Detailed Explanation

To calculate Gross Profit, we take 'Net Sales', which is the total sales minus any sales returns. Then, we adjust this figure by considering 'Opening Stock', which is what the business had at the beginning of the period. We also add 'Purchases' (what was bought during the period) minus any 'Purchase Returns'. Finally, we subtract 'Closing Stock', the inventory left at the end of the period, to reach the Gross Profit figure.

Examples & Analogies

Imagine a baker who started with some ingredients (Opening Stock), bought more flour and sugar during the month (Purchases), and ended the month with some leftover ingredients (Closing Stock). By adding up everything spent on the ingredients and subtracting the stock left, the baker can see how much money was actually made (Gross Profit) by selling cakes and pastries.

Understanding Direct Expenses

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Direct Expenses: Only expenses directly related to production/sales are included.

Detailed Explanation

Direct expenses are costs that can be directly linked to the manufacturing of products or the rendering of services. Examples include wages for factory workers, costs of shipping goods, and expenses for materials consumed in production. These costs are essential in determining the gross profit.

Examples & Analogies

Consider a car manufacturer. The wages paid to workers assembling the cars, the cost of car parts, and the shipping costs for transporting finished cars to dealers are all direct expenses. These are critical for calculating how much profit the company makes on each car sold, just like a chef needs to account for every ingredient when pricing a dish.

Key Concepts

-

Trading Account: A statement used to assess gross profit or loss.

-

Gross Profit: Revenue minus the cost of goods sold.

-

Direct Expenses: Costs directly related to business operations.

Examples & Applications

If a company has an opening stock of ₹10,000, makes purchases worth ₹50,000, has sales of ₹70,000, and the closing stock is ₹15,000, the gross profit can be calculated as follows: Gross Profit = ₹70,000 - (₹10,000 + ₹50,000 - ₹0 + ₹15,000) = ₹35,000.

A business that starts with an opening stock of ₹20,000, purchases additional stock for ₹80,000, sells goods for ₹100,000, and ends with a closing stock of ₹30,000 would calculate its gross profit as: Gross Profit = ₹100,000 - (₹20,000 + ₹80,000 - ₹0 + ₹30,000) = ₹30,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In the Trading Account, it’s clear to see, gross profit's the goal for you and me.

Stories

Imagine a baker who records how much flour he buys, sells breads, and counts his stock each night to know how much dough he earns. His Trading Account helps him see the profit he makes!

Memory Tools

Sales, Stock, Purchases: Remember the 'SSP' sequence to track trading transactions.

Acronyms

PSEG

Purchases

Sales

Expenses

Gains - key components to calculate your profit.

Flash Cards

Glossary

- Trading Account

A financial statement that shows the gross profit or loss of a business over a specific period.

- Gross Profit

The difference between net sales and the cost of goods sold.

- Direct Expenses

Costs that are directly attributable to the production or sale of goods.

- Opening Stock

The value of inventory that a business has at the beginning of an accounting period.

- Closing Stock

The value of inventory that remains unsold at the end of an accounting period.

Reference links

Supplementary resources to enhance your learning experience.