Key Principles

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Fundamental Equation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we're going to dive into the key principles of final accounts, starting with the crucial equation: Assets = Liabilities + Capital. This equation is the foundation of financial accounting. Can anyone explain what each component means?

Assets are what the business owns, right?

And liabilities are what the business owes to others.

Exactly! And capital represents the owner's equity or investment in the business. This relationship keeps the financial statements balanced. A way to remember this is 'A = L + C.' Can anyone tell me why this balance is important?

Because it ensures that everything we report in our financial statements is accurate and reflects the true financial state of a business.

Very well put! Remember, if any part of this equation isn't balanced, it indicates a potential error in financial reporting.

Going Concern Principle

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s look at the Going Concern principle. What does it mean, and why is it crucial when preparing final accounts?

It means that we assume the business will continue operating in the foreseeable future.

Correct! This assumption affects how we value assets and prepare our financial statements. Can anyone think of a situation where this principle might not hold?

Maybe if a company is facing bankruptcy? In that case, we would have to reassess asset values?

Spot on! If a business cannot continue as a going concern, we must adjust how we report our financials to reflect its real situation.

Matching and Dual Aspect Principles

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s discuss the Matching principle next. Why do you think it's important in the context of financial reporting?

It helps to ensure that we match revenues with the costs incurred to generate them in the same period.

Exactly! This gives stakeholders a clear picture of the company’s performance. How about the Dual Aspect principle? Who can explain that?

Every transaction affects at least two accounts, maintaining the balance of the accounting equation.

Right! Think of it like a seesaw; if one side goes up, the other side must come down. This balancing act ensures our accounts remain accurate.

Significance of Key Principles

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To wrap up our discussion, let's think about why these principles matter. How do they impact decision-making within a business?

They provide a framework for accuracy and consistency, which helps in making informed decisions.

Exactly! Investors, creditors, and management all rely on these principles to assess risk, profitability, and operational efficiency. Would you agree that understanding these principles is vital for a career in accounting or finance?

Definitely! It’s fundamental to everything we do in business.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

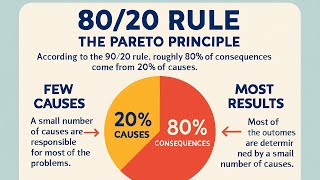

The key principles underpinning final accounts include maintaining the integrity of the accounting equation (Assets = Liabilities + Capital) and adhering to essential accounting principles such as Going Concern, Matching, and Dual Aspect. These concepts are crucial for accurate financial reporting and analysis.

Detailed

Key Principles

Final accounts form the backbone of financial reporting for any business, reflecting its financial standing at a specific point in time. Key principles governing the preparation of these accounts include:

- Assets = Liabilities + Capital: This fundamental equation illustrates that all resources owned by a business (assets) should be financed by either what is owed (liabilities) or the owner's investment (capital).

- Going Concern Principle: Financial statements are prepared with the assumption that the business will continue to operate indefinitely. This principle affects how assets and liabilities are evaluated, particularly in terms of depreciation and impairment.

- Matching Principle: Revenues and expenses are matched to the period in which they occur, allowing for a clearer view of financial performance. This ensures that income generated in a specific period is accounted for alongside the expenses incurred to generate that income.

- Dual Aspect Principle: This principle requires that every financial transaction has equal and opposite effects in at least two different accounts, maintaining the balance of the accounting equation.

Understanding these principles is essential for accurate financial reporting, compliance with regulations, and informed decision-making within any organization.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Basic Equation of Accounting

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Assets = Liabilities + Capital

Detailed Explanation

This fundamental equation of accounting states that everything the business owns (its assets) is financed either by borrowing money (liabilities) or by the owner's investment (capital). Essentially, the total value of the assets must equal the total value of the sources that financed those assets.

Examples & Analogies

Consider a simple store. If the store has $50,000 worth of inventory (assets) and has taken a loan of $20,000 (liabilities) while the owner invested $30,000 (capital), it maintains the equation: Assets ($50,000) = Liabilities ($20,000) + Capital ($30,000).

Going Concern Principle

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Must follow the Going Concern, Matching, and Dual Aspect principles.

Detailed Explanation

The Going Concern principle assumes that a business will continue to operate indefinitely unless stated otherwise. This means that the financial statements are prepared with the expectation that the business is not in the process of liquidation. This principle allows for a significant number of accounting values to be based on the assumption of ongoing operations.

Examples & Analogies

Imagine a bakery that has just opened. The owners make long-term investments in equipment, expecting to continue selling bread and pastries for years. If the business was not considered a going concern, they would have to evaluate the machinery’s worth not as an ongoing asset but rather as items to sell off, significantly lowering their perceived value.

Matching Principle

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The statement confirms adherence to the Matching principle.

Detailed Explanation

The Matching principle mandates that a business's expenses incurred in earning revenue should be recorded in the same period as the revenue they helped generate. This ensures that the financial statements accurately reflect the business's profitability during a specific period.

Examples & Analogies

Consider a car rental company. If it pays $2,000 for car maintenance in January but does not rent the car until March, the company should match that expense with the revenue generated from those rentals in March, not in January, to accurately reflect profit for the rental period.

Dual Aspect Principle

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Additionally, the statement indicates the importance of adhering to the Dual Aspect principle.

Detailed Explanation

The Dual Aspect principle states that every financial transaction affects at least two accounts, maintaining the accounting equation of assets equaling liabilities plus equity. This principle is foundational in double-entry bookkeeping, ensuring that all transactions are balanced and accurately recorded.

Examples & Analogies

Think of buying a laptop for your business for $1,000. This transaction would increase your office equipment (asset) by $1,000 and decrease your cash (another asset) by $1,000. Thus, both sides of the equation stay balanced, reflecting accurate financial health.

Key Concepts

-

Assets: Resources owned by the business.

-

Liabilities: Obligations owed to external parties.

-

Capital: Owner's equity in the business.

-

Going Concern Principle: Assumption of business continuity.

-

Matching Principle: Revenue and expense matching for accuracy.

-

Dual Aspect Principle: Every transaction affects at least two accounts.

Examples & Applications

Example of Assets: A company's cash, inventory, real estate.

Example of Liabilities: Loans, accounts payable, mortgages.

Example of Capital: Owner's investments, retained earnings.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Assets and debts, a balance we seek, / Owner's stake stays firm and meek.

Stories

Imagine a store named 'Assets Galore.' To find out how well it's doing, the owner checks the debts (Liabilities) and his own investment (Capital). If it all balances, he knows he's on track!

Memory Tools

For Going concern, think 'G' for Growth, as it signifies the business will keep going.

Acronyms

For the accounting principles, remember 'M-D-G' (Matching, Dual aspect, Going concern).

Flash Cards

Glossary

- Assets

Resources owned by the business that have economic value.

- Liabilities

Obligations or debts that the business owes to outside parties.

- Capital

The owner's claim on the assets of the business; also known as owner's equity.

- Going Concern Principle

The assumption that a business will continue to operate for the foreseeable future.

- Matching Principle

The accounting concept that expenses should be matched with the revenues they help to generate.

- Dual Aspect Principle

The principle that every financial transaction affects at least two accounts, maintaining the balance of the accounting equation.

Reference links

Supplementary resources to enhance your learning experience.