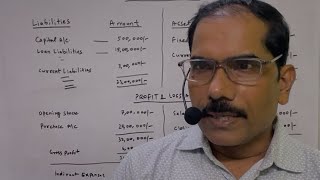

Profit and Loss Account

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Profit and Loss Account

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

The Profit and Loss Account is essential in assessing a business's financial health. Can anyone tell me what it primarily calculates?

I think it calculates the profit or loss made by the business.

Correct! It calculates either net profit or net loss by incorporating indirect expenses and incomes. Why do we need to account for these indirect expenses?

Because they impact the overall profitability, right?

Exactly! It's like assessing how much money you actually keep after covering all necessary costs. This gives a realistic picture of financial performance. Remember the acronym H.E.L.P — **H**ealth, **E**xpenses, **L**osses, and **P**rofit.

Components of Profit and Loss Account

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s dive deeper into the components of the Profit and Loss Account. Who can name some indirect expenses?

Salaries, rent, and maybe even depreciation?

Absolutely! Indirect expenses are those costs that aren't tied directly to production but are essential for business operations. Can someone share an example of indirect income?

Interest received could be an example.

Great point! Indirect incomes can bolster profitability and include incomes like commission received. To remember these, think of I.N.C.O.M.E — it stands for **I**ndirect **N**et **C**alculated **O**pportune **M**onetary **E**arnings.

Calculating Net Profit

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

How is net profit calculated? Who knows the formula?

It's net profit equals gross profit plus other incomes minus indirect expenses.

Exactly! So, if your gross profit is ₹50,000, other incomes are ₹5,000, and indirect expenses are ₹10,000, what is your net profit?

That would be ₹50,000 plus ₹5,000 minus ₹10,000, which equals ₹45,000.

Fantastic! So remembering **P.E.A.C.E** can help you: **P**rofit, **E**xpenses, **A**sset, **C**alculation, **E**arnings. It reminds us how interconnected these terms are.

Key Takeaways

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

As we conclude, let’s recap. What are the primary objectives of the Profit and Loss Account?

To calculate profit or loss and assess the operational efficiency.

Correct! It's essential for making informed business decisions. How can businesses use this information?

They can plan budgets and forecast future revenues!

Exactly! Always remember that the Profit and Loss Account serves as a financial road map for a business's success.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Profit and Loss Account is a vital financial statement that helps businesses assess their net profitability by accounting for all indirect expenses and incomes. It gives stakeholders valuable insights into financial performance over a specific period.

Detailed

Profit and Loss Account

The Profit and Loss Account is crucial for assessing a company's financial performance at the end of an accounting period. This account details both indirect expenses and indirect incomes, culminating in the calculation of net profit or net loss.

Purpose

The primary purpose of the Profit and Loss Account is to provide a clear view of a business's profitability after all operational expenses have been accounted for. This is vital for management and stakeholders as it not only reflects the income generated but also shows how efficiently a company operates.

Format

The Profit and Loss Account typically includes:

- Indirect Expenses: These are expenses not directly related to production but necessary for overall operations, including salaries, rent, and depreciation.

- Indirect Incomes: This section records incomes such as commissions and interest received.

- Net Profit Calculation: The net profit or loss is derived using the formula: Net Profit = Gross Profit + Other Incomes - Indirect Expenses. If total expenses exceed the total incomes, it results in a net loss.

This account plays a critical role in financial decision-making, offering insights that influence strategic planning and operational adjustments.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Purpose of the Profit and Loss Account

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To calculate Net Profit or Net Loss after accounting for indirect expenses and incomes.

Detailed Explanation

The Profit and Loss Account serves the critical function of determining the overall profitability of a business over a specific period. It does this by summarizing all indirect expenses and incomes, which are not directly tied to the production of goods or services. The result of this calculation is the Net Profit if incomes exceed expenses, or a Net Loss if expenses are greater than incomes.

Examples & Analogies

Think of a restaurant that tracks all its sales (income) and operational costs such as salaries, rent, and office expenses (indirect expenses). By comparing these costs to what they earn from selling food and drinks, the restaurant can see if they’re making money (Net Profit) or if their costs are higher than their sales (Net Loss).

Format of the Profit and Loss Account

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Dr. (Debit) Amount (₹) Cr. (Credit) Amount (₹)

Indirect Indirect

Expenses: Incomes:

– Salaries xxxxx – Commission xxxxx

Received

– Rent xxxxx – Interest xxxxx

Received

– Depreciation xxxxx – Discount xxxxx

Received

– Office xxxxx

Expenses

– Selling xxxxx

Expenses

– Bad Debts xxxxx

– Interest on xxxxx

Loan

Net Profit xxxxx (If debit > xxxxx (transferred credit: Net Loss)

Total xxxxx Total xxxxx

Detailed Explanation

The format of the Profit and Loss Account is laid out in a structured manner that separates expenses and incomes. On the left side (Debit), we list all the indirect expenses, which are costs that are necessary for operations but not directly tied to production. On the right side (Credit), we list all the indirect incomes that the business has earned. The net result is calculated at the bottom: if total incomes are greater than total expenses, a Net Profit is reported; if expenses exceed incomes, a Net Loss is reported.

Examples & Analogies

Imagine a baker who tracks their monthly earnings and expenses. They list their costs for rent, utilities, and salaries (indirect expenses) on one side, while on the other they write down money made from selling pastries (indirect incomes). At the end of the month, they calculate how much money is left—this tells them if they made a profit or faced a loss, just like filling out a scorecard after each game.

Key Concepts of the Profit and Loss Account

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Indirect Expenses: Costs not directly related to manufacturing but necessary for operations.

• Net Profit = Gross Profit + Other Incomes – Indirect Expenses

Detailed Explanation

Key concepts of the Profit and Loss Account include understanding what constitutes indirect expenses. These are necessary costs that support the business's operations, such as rent and administrative salaries, but do not contribute directly to producing goods. The calculation for Net Profit incorporates Gross Profit, any other incomes earned by the business, and deducts indirect expenses to arrive at a final figure. Understanding these elements is essential for analyzing the profitability and sustainability of a business.

Examples & Analogies

Consider a software company. Even if they are making a good profit from selling their product (Gross Profit), they still have costs like office lease, utilities, and regular employee paychecks (indirect expenses). Therefore, to truly understand if they’re succeeding financially, they must subtract these essential operational costs from their earnings. If they earn more than they’ve spent, they’ve made a Net Profit, which shows their real financial health.

Key Concepts

-

Indirect Expenses: Costs necessary for operations but not directly tied to production.

-

Indirect Incomes: Revenues from sources not directly related to the main business operations.

-

Net Profit: The final profit amount after all applicable expenses are deducted from total revenues.

Examples & Applications

If a company had total revenues of ₹100,000, indirect expenses of ₹40,000, and indirect incomes of ₹10,000, the net profit would be ₹70,000.

If the gross profit is ₹50,000, and indirect expenses amount to ₹20,000 with no indirect incomes, the net profit is ₹30,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In the Profit and Loss you will see, how much profit we made, it's the key! Expenses tallied, incomes bright, Net profit shows our financial light!

Stories

Imagine a baker, who wants to know, after all costs, how much money will flow? He counts his ingredients, his rent, and his staff, to see if his business can provide him a laugh.

Memory Tools

P.L.A.N — Profit, Loss, Activities, Net to summarize what's spent and what was met.

Acronyms

I.N.C.O.M.E for Indirect Net Calculated Opportune Monetary Earnings.

Flash Cards

Glossary

- Profit and Loss Account

A financial statement that summarizes revenues, costs, and expenses incurred during a specific period, typically a fiscal quarter or year.

- Indirect Expenses

Costs that are not directly tied to the production of goods or services but are necessary for the business's operations, such as rent and salaries.

- Net Profit

The total profit after all expenses, including indirect expenses, are deducted from total revenues.

- Indirect Incomes

The various types of income received that are not directly tied to the primary business operations.

Reference links

Supplementary resources to enhance your learning experience.