Summary

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Final Accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are discussing Final Accounts. Can anyone tell me what they think Final Accounts are?

Are they the financial statements that show how well a business performed?

Exactly! Final Accounts are crucial as they summarize the financial activities of a business. They help us determine profitability and financial standing.

What exactly do they include?

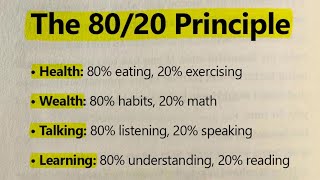

Good question! Final Accounts typically consist of a Trading Account, a Profit and Loss Account, and a Balance Sheet. Remember the acronym 'TPB' for these three statements: T for Trading, P for Profit and Loss, and B for Balance Sheet.

Why is it important to track profitability?

Great point! Tracking profitability helps stakeholders assess the performance and make informed decisions. Summarizing the main points today: Final Accounts provide critical insights into a business's financial health and operational efficiency.

Components of Final Accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's look closely at the components of Final Accounts. Who can name one of these components?

The Trading Account?

Yes! The Trading Account determines gross profit or loss. It's important to understand the flow from sales, purchases, and adjustments. Who can explain how we compute gross profit?

Is it Net Sales minus the cost of goods sold?

Correct! We also subtract direct expenses. Remember that 'Gross = Net - Direct Fruits'. Let's move on to the Profit and Loss Account. What is its purpose?

It shows the net profit or loss after considering indirect expenses.

Exactly! And last, we have the Balance Sheet, which provides a snapshot of financial position. The formula 'Assets = Liabilities + Capital' is key here!

Significance and Limitations of Final Accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's discuss the significance of Final Accounts. Why do you think they're critical for businesses?

They help in determining taxes and budgets.

Exactly! They aid in various analytical functions. However, what are some limitations of these accounts?

They don't account for inflation or market changes.

Correct again! Financial statements are based on historical data and might not reflect current market conditions effectively. So, to summarize: While Final Accounts are important, one must consider their limitations during analysis.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The chapter outlines the significance of final accounts including the Trading Account, Profit & Loss Account, and Balance Sheet. These accounts reveal the business's profitability, financial position, and operational efficiency, which are essential for decision-making by stakeholders.

Detailed

Summary of Final Accounts

The final accounts of a business serve as a structured summary of its financial activities over a specific accounting period. These accounts include the Trading Account, which helps determine gross profit or loss; the Profit and Loss Account, which measures net profitability; and the Balance Sheet, which reflects the financial position of the business.

The significance of these accounts lies in their ability to provide insights into profitability, financial position, and operational efficiency, pivotal for stakeholders such as investors, creditors, and management. While final accounts are highly informative, their interpretation should be supplemented with other analyses for comprehensive decision-making, as they may not account for non-financial factors or changes in market conditions.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Overview of Final Accounts

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Final accounts provide a structured summary of the financial activities of a business.

Detailed Explanation

Final accounts are essential documents that outline the financial transactions and performance of a business over a specific accounting period. They are structured to give a clear picture of how the business has been performing financially, enabling stakeholders to assess its viability and success.

Examples & Analogies

Think of final accounts like a report card for students. Just as a report card summarizes a student's performance over a term—grades in subjects, attendance, etc.—final accounts summarize a company’s financial performance, showing profits, losses, and overall financial health.

Trading and Profitability Assessment

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The Trading Account evaluates gross profit or loss, the Profit and Loss Account measures net profitability, and the Balance Sheet reflects the financial position.

Detailed Explanation

The Trading Account helps determine the gross profit or loss of a business which is earned directly from its core operations, like selling products or services. The Profit and Loss Account accounts for all indirect expenses (like rent and salaries) and calculates the net profit or net loss. Meanwhile, the Balance Sheet gives a snapshot of what the business owns (assets) and what it owes (liabilities) at a particular point in time, emphasizing the overall financial position of the company.

Examples & Analogies

Consider a bakery. The Trading Account would summarize how much it earned from selling cakes and bread versus how much was spent on flour, sugar, and salary for bakers. The Profit and Loss Account would then take this gross profit and subtract other costs, like rent for the shop or utility bills, to find out the net profit. Finally, the Balance Sheet would look at all the ovens, ingredients, and cash in the bakery against loans and bills owed to suppliers.

Importance in Business Analysis

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These accounts are essential tools for business analysis and strategy formulation.

Detailed Explanation

Final accounts are not just for record-keeping; they serve as vital tools for decision-making and strategy development in a business. Investors, managers, and financial analysts rely on them to evaluate how well a company is performing, make informed decisions, and strategize for the future.

Examples & Analogies

Imagine a sports team looking to improve its performance. Just like a coach reviews game statistics and player performances to decide on training focus or roster changes, business leaders review final accounts to decide on budgeting, scaling operations, or cutting costs.

Supplementary Analysis Needed

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Although highly informative, their interpretations must be supplemented with other analyses for comprehensive decision-making.

Detailed Explanation

While final accounts provide a wealth of information, they alone do not give the complete picture of a business's health or market conditions. Factors such as market trends, customer satisfaction, and economic changes should also be considered alongside final accounts for robust decision-making.

Examples & Analogies

Think about a weather forecast. While it can tell you if it's likely to rain or be sunny, it may not cover local events happening or changes in the environment that could affect your day. Similarly, business leaders need to consider both financial statements and external factors for the best decisions.

Key Concepts

-

Final Accounts: Summarize the financial activities of a business over an accounting period.

-

Trading Account: Determines the gross profit or loss of a business.

-

Profit and Loss Account: Calculates net profit or loss after accounting for indirect expenses.

-

Balance Sheet: Reflects the financial position of a business at a particular date.

Examples & Applications

A business generated sales of ₹100,000, had cost of goods sold of ₹70,000, resulting in a gross profit of ₹30,000.

A business with total assets valued at ₹200,000 and liabilities of ₹100,000 would show an owner's equity of ₹100,000 on its balance sheet.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In the Trading Account, sales we see, Gross Profit shines, it's the key!

Stories

Imagine a storekeeper keeping note of sales and expenses, first noting down what was made from selling cupcakes - this is like the Trading Account - always measuring profit!

Memory Tools

Think of T-P-B: Trading for Gross Profit, Profit & Loss for Net Profit, and Balance Sheet for keeping track.

Acronyms

TPB

for Trading

for Profit and Loss

and B for Balance Sheet.

Flash Cards

Glossary

- Final Accounts

Financial statements prepared at the end of an accounting period that summarize the financial activities of a business.

- Gross Profit

The difference between sales and the cost of goods sold.

- Net Profit

The profit remaining after all expenses, including direct and indirect costs, are deducted from gross profit.

- Balance Sheet

A statement that presents the financial position of a business at a specific date.

- Assets

Resources owned by a business.

- Liabilities

Obligations or debts owed to outsiders.

- Owner's Equity

The owner's claim on the business's assets.

Reference links

Supplementary resources to enhance your learning experience.