Purpose - 17.5.1

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Importance of Final Accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, class! Today, we're investigating the importance of Final Accounts. Can anyone tell me what they think the primary purpose is?

I think it's to see if the company made a profit or a loss.

Exactly! We calculate gross profit or loss through the Trading Account. What other reasons might there be for preparing these accounts?

Maybe to check the financial position of the business?

Yes! The Balance Sheet shows us the financial position. Remember: Assets = Liabilities + Owner's Equity. This ensures that we have a clear picture of our financial health.

But what if the business needs to prove something for taxes or loans?

Great point! Final Accounts are essential for compliance with tax and legal requirements. They ensure transparency in financial activities.

So, let’s summarize! Final Accounts help in determining profitability, evaluating the financial position, assessing performance, and ensuring compliance. Each component plays a crucial role in managing a business.

Components of Final Accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s explore the components of Final Accounts. Who can name them?

There’s the Trading Account, Profit & Loss Account, and Balance Sheet, right?

That's correct! Can anyone explain what each one does?

The Trading Account shows us if we made a gross profit or loss.

The Profit & Loss Account tells us about our net profit or loss after all expenses.

And the Balance Sheet shows our financial position at a point in time?

Exactly! Remember: The balance sheet reflects what we own and owe. It’s crucial for understanding our financial standing.

To sum it up: Each component of Final Accounts serves a unique purpose that collectively enables us to evaluate a business’s financial performance.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section details the purpose of Final Accounts, which include determining gross profit, evaluating financial position, and ensuring compliance with legal requirements. Final accounts, comprising Trading, Profit & Loss Accounts, and Balance Sheets, are crucial for stakeholders to analyze business health and performance.

Detailed

Detailed Summary

The section on the 'Purpose' of Final Accounts effectively encapsulates core reasons why these accounts are integral to any business. Final Accounts serve multiple objectives, primarily focusing on:

- Determining Gross and Net Profit or Loss: The Trading Account is responsible for evaluating the gross profit or loss, aiding in understanding direct operational profitability.

- Evaluating Financial Position: The Balance Sheet provides insights into the overall financial standing of the business, allowing stakeholders to assess whether the company can meet its obligations.

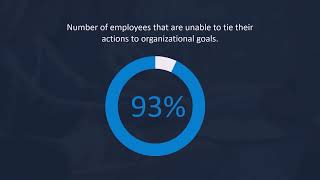

- Assessing Performance: These statements are crucial for owners and stakeholders as they illustrate how well the business performs against expected benchmarks.

- Ensuring Compliance: Final Accounts help fulfill legal and tax requirements, promoting transparency.

The culmination of these purposes underlines the significance of preparing Final Accounts accurately, as they inform essential business decisions, strategies, and processes.

Youtube Videos

Key Concepts

-

Final Accounts: Financial statements prepared at the end of an accounting period to ascertain business results and financial position.

-

Trading Account: Determines gross profit or loss during an accounting period.

-

Profit & Loss Account: Calculates net profit or loss after accounting for expenses.

-

Balance Sheet: Presents the financial position of the business at a specific date.

Examples & Applications

Example of a Trading Account: Sales of ₹100,000; Purchases of ₹70,000; Closing Stock of ₹20,000. Gross Profit = 100,000 - (70,000 - 20,000) = ₹50,000.

Example of a Balance Sheet: Assets totaling ₹300,000 and Liabilities totaling ₹150,000, illustrating owner’s equity of ₹150,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Final Accounts you need to know; Gross and Net, they help you grow.

Stories

Imagine a shop owner watching her daily sales. She records her sales and expenses at the end of the month to see if her shop is thriving or struggling. This process is essential for her to plan the future.

Memory Tools

Remember GNP (Gross, Net, Position) for the purposes of Financial Accounts.

Acronyms

F.A.C.E. - Financial Accounts

Calculate Earnings

reporting essential.

Flash Cards

Glossary

- Gross Profit

The profit a company makes after deducting the costs associated with making and selling its products.

- Net Profit

The amount of money remaining after all expenses, taxes, and costs have been deducted from total revenue.

- Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time.

- Trading Account

An account that calculates the gross profit or loss made during a trading period.

- Profit and Loss Account

An account that assesses a company’s financial performance over a specified period, focusing on revenues and expenses.

Reference links

Supplementary resources to enhance your learning experience.