Importance of Final Accounts

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the tax implications of final accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Class, today we'll discuss the role of final accounts in determining tax liability. Who can tell me why tax considerations are important for a business?

They help businesses know how much tax they need to pay.

Exactly! Final accounts summarize financial data, making it easier for businesses to calculate taxable income. Can anyone name the components of the final accounts used for this?

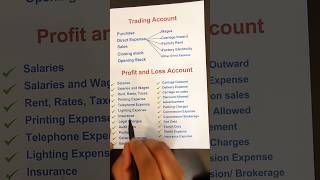

The Trading Account, Profit & Loss Account, and Balance Sheet.

Great! Together, they provide a clear picture of income and expenses, which is vital for tax assessments.

Remember the acronym 'TAP': Tax liability can be assessed through the Trading, Accounting, and Profit & Loss statements. This will help you recall their significance.

So, they're not just for showing profit but also for meeting legal obligations?

Exactly! Let's remember that final accounts are not only about profitability but also about compliance.

In summary, final accounts are essential for determining tax liabilities by providing clear financial statements required for assessments.

Final accounts in budgeting and forecasting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's shift gears to budgeting and forecasting. How do you think final accounts help in this area?

They show how much money the business made or lost in the past, which helps predict future income.

Absolutely! By analyzing past performance through final accounts, businesses can create informed budgets for future activities. Who can give me an example of how this might work?

If a company made a lot of profit last year, it might budget for expanding next year.

Nicely put! Additionally, using a budgeting framework like the acronym 'BAP' — Budgeting through Analysis of Performance — can help you remember how critical final accounts are in planning.

It's like building a roadmap based on previous trips!

Exactly! Just remember that final accounts provide not just records but a road map for financial planning. In conclusion, they are vital for creating future budgets and forecasts based on informed assessments.

Evaluating creditworthiness through final accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's talk about creditworthiness. Why do you think final accounts matter for banks and investors?

They help them see whether a business will repay loans.

Exactly right! Final accounts display a business's financial health, helping assess risks for those who might lend money. Can anyone think of a specific document they'll look at?

The Balance Sheet would show if the business has more assets than liabilities.

Correct! Banks often evaluate the stability reflected in the Balance Sheet’s components. Remember the mnemonic 'SAFE' — Stability Assessment From Earnings — to recall why final accounts are crucial for credit assessments.

So, it's like a financial health check?

That's a perfect analogy! Thus, in summary, final accounts are indispensable for evaluating a business's creditworthiness and informing lending decisions.

Compliance and auditing importance of final accounts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss compliance and auditing. How do final accounts support these functions?

They provide a clear record that auditors can review.

Exactly! Final accounts are crucial for regulatory compliance and documenting financial activities. What might happen if a business doesn’t keep them accurately?

They could get penalties or fines.

Right! This is why keeping accurate accounts supports transparent operations. Remember the acronym 'CAT' — Compliance And Transparency — to emphasize their importance in this context.

So it's not just numbers but also a way to ensure the business operates transparently?

Exactly! They ensure that businesses operate within legal bounds. To recap, final accounts play vital roles in compliance and auditing by providing transparent financial records.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The importance of final accounts lies in their role in determining tax liabilities, aiding budgeting and forecasting, evaluating business creditworthiness, ensuring compliance, and supporting internal control and decision-making processes.

Detailed

Importance of Final Accounts

Final accounts are key financial statements prepared at the end of an accounting period to provide a conclusive summary of a business's performance and financial status. They are vital for the following reasons:

- Tax Liability Determination: Final accounts allow businesses to calculate the taxes they owe, ensuring that they remain compliant with tax laws.

- Budgeting and Forecasting: Businesses use final accounts to create future budgets and forecasts based on historical data, enabling effective financial planning.

- Creditworthiness Assessment: Investors and banks utilize final accounts to evaluate a business's capability to repay debts and sustain operations, which impacts lending decisions.

- Auditing and Compliance: Final accounts are essential for auditing processes and verifying compliance with legal and regulatory standards, reducing the risk of penalties.

- Internal Control and Decision Making: Companies rely on final accounts for informed decision-making, evaluating operational efficiency, and maintaining financial health.

Overall, final accounts are indispensable tools that provide insights into profitability, operational efficiency, and financial transparency.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Determining Tax Liability

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Helps in determining tax liability.

Detailed Explanation

Final accounts are essential for assessing the tax obligations of a business. By calculating profit and loss and evaluating financial performance, businesses can determine how much tax they owe based on government regulations. This estimate is crucial because higher profits may result in higher tax liabilities.

Examples & Analogies

Consider a small business that has generated considerable profits this year. By preparing final accounts, the owner can see the exact profit and then calculate how much tax to pay. It is similar to preparing a budget for a big purchase; you need to know how much money you have before deciding how much you can afford to spend.

Aiding Budgeting and Forecasting

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Aids in budgeting and forecasting.

Detailed Explanation

Final accounts provide historical data about a business's financial performance, which is invaluable for future planning. By analyzing past revenues and expenses, businesses can create more accurate budgets and forecasts. This forward-looking view helps in setting realistic goals and preparing for financial needs.

Examples & Analogies

Think of preparing final accounts like checking your past spending before planning a vacation. If you know how much you spent last year and what you earned, you can better estimate your budget for this year without overspending.

Evaluating Creditworthiness

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Used by investors and banks to evaluate creditworthiness.

Detailed Explanation

Investors and banks rely on final accounts to assess the financial health of a business before making lending or investment decisions. A solid set of final accounts, showing consistent profitability and strong financial position, signals that a business is a reliable investment or credit risk.

Examples & Analogies

Imagine you're a bank official reviewing a loan application. The borrower's final accounts would serve as a report card, showing their past financial performance. Just like how students' grades can determine their chances of getting into a good college, a business's final accounts can influence whether they secure funding.

Essential for Auditing and Compliance

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Essential for auditing and compliance.

Detailed Explanation

Final accounts are vital for the auditing process, ensuring that financial reports reflect accurate business transactions. They must comply with legal regulations, helping authorities verify that businesses are reporting income and expenses correctly, thus protecting stakeholders' interests.

Examples & Analogies

Think of final accounts like the official records in a school that track student attendance and grades. Just as these records ensure that everything is in order and compliant with educational standards, final accounts ensure that businesses adhere to financial regulations and standards.

Internal Control and Decision Making

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Useful in internal control and decision-making.

Detailed Explanation

Final accounts help management understand the financial performance of different business segments. This insight enables effective internal controls and informed decision-making regarding resource allocation, investments, and operational improvements.

Examples & Analogies

Imagine a manager in a restaurant reviewing the final accounts. By looking at these records, they can see which menu items are profitable and which aren't. This information helps them decide whether to continue a dish or introduce new options, just like using past sales data to steer the future direction of the restaurant.

Key Concepts

-

Tax Liability: The specific amount a business is required to pay in taxes, which is calculated from the final accounts.

-

Budgeting: The use of past financial data from final accounts to form future budgets.

-

Creditworthiness: Assessment of a business's ability to meet its debt obligations based on final accounts.

-

Auditing: Process involving the verification of financial records through final accounts.

-

Compliance: Adhering to laws and regulations reflected in final accounts.

Examples & Applications

A business generates a profit of ₹300,000 detailed in the Profit & Loss Account, which helps determine its tax liability more accurately.

A company planning an expansion analyzes last year's final accounts to decide on its budgeting for new equipment.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Final accounts, so clear and bright, / Show our profits, keep us right. / For tax and budgets, they guide our way, / Helping us lead in the financial fray!

Stories

Once upon a time, a business named 'Success Corp' used final accounts every year. They calculated their taxes, planned future budgets like a map, and gained the trust of their investors — all thanks to their clear and honest final accounts!

Memory Tools

Remember 'T-B-C-A': Taxes, Budgets, Credit, Audits – all key reasons to keep final accounts!

Acronyms

CAT — Compliance And Transparency — crucial for maintaining good business practices!

Flash Cards

Glossary

- Final Accounts

Financial statements prepared at the end of an accounting period to evaluate business results and financial position.

- Tax Liability

The total amount of tax that an entity is legally required to pay to the tax authorities.

- Creditworthiness

An assessment of a borrower's ability to repay a loan based on their financial health.

- Auditing

An independent examination of financial information of an entity to provide an opinion on its fairness.

- Budgeting

The process of creating a plan to spend a company's financial resources.

Reference links

Supplementary resources to enhance your learning experience.