Compound Interest (CI)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Compound Interest

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we’re diving into Compound Interest. Can anyone tell me what they think that means?

Does it mean we earn interest on our interest?

Exactly! It's when interest is calculated not just on the principal but also on the previously earned interest. This is why it's important for investments.

How is it different from Simple Interest?

Great question! In Simple Interest, you only earn interest on the original amount. In Compound Interest, the interest keeps growing on itself, leading to more significant growth over time.

So we can say CI is an exponential growth method?

Yes! One way to remember this is the acronym 'PAG', for Principal, Accumulated interest, and Growth.

The Formula for Compound Interest

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand the concept, let's look at the formula. Does anyone want to give it a try?

A = P(1 + r/n)^(nt)?

Excellent! Can anyone explain what each part means?

A is the final amount, P is the principal, r is the interest rate, n is how often interest is compounded, and t is the number of years.

Fantastic! It’s key to remember that more frequent compounding leads to a larger final amount. For memory, think 'PAINT' for Principal, Amount, Interest rate, Number of times, and Time.

Real-World Application of CI

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's talk about where we see CI in real life. Can anyone give me an example?

Like savings accounts!

Exactly! Banks pay interest on accounts using CI, meaning your savings grow over time. Why do you think it’s important to start saving early?

So you can benefit from more compounding time?

Exactly right! The earlier you invest, the more interest you can earn. Remember the mantra: 'Start Early, Grow Wealthy!'

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore the concept of Compound Interest (CI), emphasizing its formula, significance in financial decision-making, and how it contrasts with Simple Interest. CI is essential for understanding how investments can multiply over time through compounded growth.

Detailed

Detailed Summary of Compound Interest (CI)

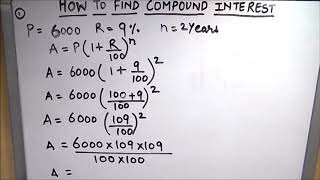

Compound Interest (CI) is a powerful financial concept that allows investors to earn interest not just on their initial principal but also on the interest that accumulates over time. This section outlines the formula for calculating CI, which is given by:

Formula:

A = P(1 + r/n)^(nt)

- A = final amount

- P = principal amount (initial investment)

- r = annual interest rate (in decimal)

- n = number of times the interest is compounded per year

- t = time in years

The computation of CI reflects real-world financial scenarios as it demonstrates how investments grow more significantly compared to Simple Interest, where interest is earned solely on the original principal. This multiplicative effect implies that the sooner an investment is made and the longer it remains invested, the greater returns it will yield due to the nature of compounding. Understanding CI is crucial for budgeting, investment appraisals, and retirement planning.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Formula for Compound Interest

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Formula:

A = P(1 + r/n)^(nt)

Where:

- A = final amount

- P = principal

- r = annual interest rate

- n = number of compounding periods per year

- t = number of years

Detailed Explanation

The formula for Compound Interest (CI) allows us to calculate the total amount of money accumulated over time, including the interest added to the principal. Here’s a breakdown:

- A represents the final amount you will have after compounding.

- P is the initial amount you invest or borrow, known as the principal.

- r is the annual interest rate expressed as a decimal (e.g., 5% would be 0.05).

- n tells us how often the interest is applied in a year (like annually, monthly, etc.).

- t is the total number of years the money is invested or borrowed.

By plugging these values into the formula, you can find out how much money you will have in the future.

Examples & Analogies

Imagine you invest ₹10,000 at an annual interest rate of 5%, compounded yearly, for 3 years. Using the formula, you can calculate how much you'll have after those 3 years. Each year, not only is your original ₹10,000 accumulating interest, but that interest also earns interest in the following years – like a snowball getting bigger the longer it rolls downhill.

Calculation of Compound Interest

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

CI = A - P

Detailed Explanation

This part of the compound interest concept explains how to determine just the interest earned on the investment, separate from the principal. After calculating the total amount (A) using the formula above, you subtract the principal (P) to find out how much interest you earned. This tells you the actual benefit you've gained from investing your money over time.

Examples & Analogies

Continuing the previous example, if after 3 years your investment grows to ₹11,576, you can find your compound interest by subtracting the original ₹10,000 principal: ₹11,576 - ₹10,000 = ₹1,576. So, you earned ₹1,576 just from the interest, illustrating how your money worked for you.

Impact of Compounding on Real-World Financial Decisions

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interest is calculated on the principal + accumulated interest.

- More realistic for real-world financial decisions.

Detailed Explanation

One of the key points about compound interest is that it allows interest to earn interest. This makes the growth of your investment faster over time compared to simple interest, where interest is only calculated on the original principal. Understanding CI is vital for making informed financial decisions, whether you’re saving for retirement, investing in stocks, or evaluating loans.

Examples & Analogies

Think of compounding like planting a tree. Initially, a tree is small (the principal). As time passes, it grows (interest adds on), and even those new branches (interest earnings) grow leaves that further contribute to its size (more interest). The longer you leave your money invested, like a tree taking years to grow, the more significant the final result, demonstrating the power of patience in finance.

Key Concepts

-

Compound Interest: Earning interest on the principal plus accumulated interest.

-

Formula for CI: A = P(1 + r/n)^(nt), showing how the final amount is calculated.

-

Importance of Compounding: More frequent compounding results in greater final amounts.

Examples & Applications

If you invest ₹10,000 at an interest rate of 5% compounded annually for 3 years, the total amount would be A = ₹10,000(1 + 0.05/1)^(1*3) = ₹11,576.25.

For a ₹5,000 investment at 4% interest compounded quarterly over 5 years, you'd calculate A = ₹5,000(1 + 0.04/4)^(4*5) = ₹6,083.32.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Compound interest is quite a treat, it grows and grows, oh isn’t it neat!

Stories

Imagine a tree that doubles its fruit every season. Just like that, with compound interest, your money multiplies with each passing year.

Memory Tools

Remember 'PAINT' for how to calculate CI: Principal, Amount, Interest rate, Number of times, and Time.

Acronyms

Use 'PAG' to remember

Principal

Accumulated interest

Growth of your investment.

Flash Cards

Glossary

- Compound Interest

Interest calculated on the initial principal and also on the accumulated interest from previous periods.

- Principal (P)

The original sum of money invested or loaned.

- Annual Interest Rate (r)

The percentage at which interest is calculated on the principal annually.

- Compounding Period (n)

The frequency with which interest is applied to the principal balance.

- Final Amount (A)

The total amount accrued after interest has been applied over a period.

Reference links

Supplementary resources to enhance your learning experience.