Continuous Compounding

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Continuous Compounding

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we will explore continuous compounding, which is when interest is compounded infinitely. It allows the investment to grow at a faster rate than traditional compounding methods. Can anyone explain why continuous compounding might be beneficial?

Is it because it generates more interest over time?

Exactly! Because interest is calculated and added continuously, your money can grow faster. The formula we'll use is FV = P × e^(rt). What does 'e' represent in this formula?

Is it Euler's number? Like the one we use in exponential functions?

Absolutely! Understanding this concept is crucial in finance. Let's dive deeper into how to apply this formula with some examples.

Application of Continuous Compounding Formula

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To illustrate continuous compounding, let's assume you invest ₹1,000 at an interest rate of 5% for 3 years. What is the future value using the continuous compounding formula?

So, we would replace P with ₹1,000, r with 0.05, and t with 3 years?

Correct! The next step is to calculate FV = ₹1,000 × e^(0.05 × 3). Remember, you can approximate e to 2.718. Who can help me with the math here?

Calculating that would give us around ₹1,161.83. That's more than if we compounded annually!

Exactly! Continuous compounding yields more returns. Let's summarize: The more frequently interest is compounded, the greater the future value of your investment.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Continuous compounding is a financial concept where interest is compounded infinitely over a given time period, allowing for more frequent addition of interest and resulting in higher returns. The formula FV = P × e^(rt) is used to calculate future value, where e is approximately 2.718, reflecting the continuous growth nature of this method.

Detailed

Continuous Compounding

Continuous compounding refers to scenarios where interest is compounded at every possible instant, resulting in the maximum amount of interest accrual. This concept is particularly useful in finance, as it leads to higher returns compared to annual, semi-annual, or monthly compounding.

Formula

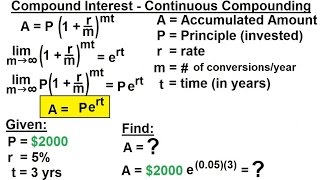

The formula for calculating the future value (FV) using continuous compounding is:

FV = P × e^(rt)

Where:

- FV is the future value

- P is the principal amount (the initial investment)

- e is Euler's number (approximately 2.71828)

- r is the annual interest rate (expressed as a decimal)

- t is the time in years

Significance in Finance

Understanding continuous compounding is significant for tech students as it provides a solid foundation for more complex financial calculations, investment strategies, and pricing in financial products. This knowledge bridges the gap between pure technical expertise and financial acumen.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Continuous Compounding

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

When compounding occurs infinitely frequently.

Detailed Explanation

Continuous compounding refers to the process of calculating interest on an investment or loan continuously, rather than at set intervals such as annually or monthly. This means that rather than waiting until the end of a compounding period to calculate interest, the interest is being calculated at every moment in time. This results in slightly more interest than traditional compounding methods that occur at regular intervals.

Examples & Analogies

Imagine you have a small plant that grows a little bit every second instead of waiting for a week to grow just a little bit. If you were to compare this growth to interest accumulation, the plant continually gets taller without having to wait for specific times to measure its growth—this is akin to how continuous compounding works.

Formula for Continuous Compounding

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Formula:

FV=P×ert

Where e≈2.718

Detailed Explanation

The formula for calculating the future value (FV) using continuous compounding is given by FV = Pe^(rt). In this formula, P represents the principal amount, r is the annual interest rate expressed as a decimal, t is the time in years, and e is a constant approximately equal to 2.718, which is known as Euler's number. This formula allows you to determine how much an investment will grow when interest is compounded continuously.

Examples & Analogies

Suppose you invest ₹1,000 at an annual interest rate of 5% for 3 years. Using the formula FV = 1000 × e^(0.05×3), you can compute how much your investment will grow if interest is added every moment for 3 years. This concept can be related to a snowball rolling down a hill: the longer it rolls, the bigger it gets, just as money accumulates exponentially when compounded continuously.

Key Concepts

-

Continuous Compounding: Interest is calculated infinitely, leading to exponential growth.

-

Future Value: The total value of an investment after a certain period with interest applied.

-

Euler's Number (e): The mathematical constant used in continuous compounding formulas.

Examples & Applications

If ₹2,000 is invested at a 6% interest rate for 4 years, the future value using continuous compounding would be approximately ₹2,569.57.

For an investment of $1,500 at an interest rate of 4% for 5 years, the future value reaches roughly $1,822.12 with continuous compounding.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

With growth that never ends, money climbs high, in e we trust, watch it fly!

Stories

Once upon a time, a clever investor named Sam learned about continuous compounding. He found that by using the magic number 'e', his investments grew faster than ever. He shared this secret with friends, who also wanted their money to flourish continuously.

Memory Tools

To remember the formula, think: 'P e rt' – Principal, e, rate, and time, together they'll climb.

Acronyms

FIVE

Future Investment Value with e - 'FV = P × e^(rt)'.

Flash Cards

Glossary

- Continuous Compounding

A method of compounding interest where interest is calculated and added to the principal an infinite number of times.

- e

Euler's number, approximately equal to 2.718, used in continuous compounding calculations.

- Future Value (FV)

The value of an investment at a specified future date based on earning potential.

Reference links

Supplementary resources to enhance your learning experience.