Time Value of Money

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Time Value of Money

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome everyone! Today, we are diving into the concept known as the Time Value of Money, or TVM. This principle states that a sum of money today is worth more than the same sum in the future due to its potential earning abilities. We often abbreviate this idea as TVM. Can anyone tell me why that might be?

I think it’s because of interest rates and investments!

Exactly! Money today can earn interest, which is one reason why it has more value now than later. Can anyone think of other factors that might affect this value?

What about inflation? Doesn’t that reduce what money can buy in the future?

Yes! Excellent point. Inflation does diminish purchasing power over time. So we can remember three main reasons for TVM: inflation, opportunity cost, and risk. Let’s keep these in mind as we explore further.

Components Influencing TVM

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s now break down the components that influence TVM. First, we have the principal amount, or P, which is the initial amount of money. Student_3, can you explain why it's important?

The principal is the base amount we start with for investments or loans, right?

Spot on! Next, we have the interest rate, r. Why do we care about this rate?

It tells us how much the money will grow over time, so we need to know it to calculate earnings.

Exactly! Now consider the time period, t, and the frequency of compounding. How do these impact our decisions?

Longer periods and more frequent compounding mean more interest earned, right?

Correct! The essence of TVM relies on these components. Let’s use these ideas in examples.

Simple vs. Compound Interest

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand TVM, let’s discuss simple and compound interest. Simple interest is calculated only on the principal. Can anyone remember the formula for simple interest?

It’s SI equals P times r times t, divided by 100!

Spot on! And compound interest? How does it differ?

Compound interest includes interest on previously earned interest, so it grows faster.

Great observation! The formula for compound interest involves repeated calculations over the compounding periods. Let’s apply these concepts to some numerical examples next.

Future Value (FV) and Present Value (PV)

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

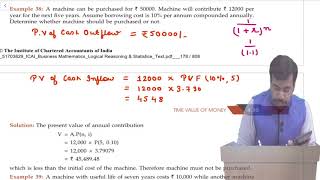

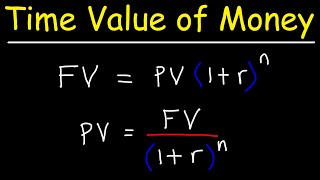

Now, let’s look at future and present values. FV represents the worth of current cash flows in the future. Can anyone recall the formula for future value?

It’s FV = PV multiplied by (1 + r) to the power of t!

Exactly! Now, what about present value? Why is it important?

It shows how much future cash flows are worth today, which helps in evaluating investments!

Precisely! Knowing how to calculate FV and PV will guide your investment assessments.

Applications of TVM in Business and Technology

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s examine applications of TVM in business and tech startups. For instance, how does TVM affect capital budgeting decisions?

It helps determine if an investment is worthwhile and how long it will take to break even.

Exactly! TVM helps assess profitability in project proposals and impacts loan amortization schedules. How do you think it impacts software cost justification?

It helps evaluate whether building software is more cost-effective than licensing, factoring in future returns!

Well said! Understanding these applications ensures you’ll effectively manage resources in your future careers.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Understanding the Time Value of Money (TVM) is crucial for making informed financial decisions. It explains how money's value changes over time due to factors like interest rates, inflation, and investment opportunities, influencing key areas such as investment appraisal and project evaluation.

Detailed

The Time Value of Money (TVM) is a foundational concept in finance, emphasizing that money received today is worth more than the same amount received in the future due to its potential earning capacity. This principle underpins numerous financial decisions relevant to both personal finance and corporate finance, including investments, loans, and retirement planning. Key components influencing TVM include the principal amount, interest rate, time period, and compounding frequency, which affect calculations of both simple and compound interest. Furthermore, the TVM allows for the determination of future value (FV) and present value (PV), essential concepts for assessing the worth of cash flows over time. This section explores various applications of TVM in business and technology startups, as well as advanced concepts such as discounted cash flow (DCF) analysis and continuous compounding. Understanding these principles equips BTech CSE graduates with critical financial literacy, aiding them in strategic decision-making in their careers.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Concept of Time Value of Money

Chapter 1 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

In finance, the Time Value of Money (TVM) signifies that money available today is worth more than the same amount in the future due to its potential earning capacity.

Detailed Explanation

The Time Value of Money suggests that money you have today is more valuable than money you will receive in the future. This is because you can invest today's money and earn interest or returns on it. Thus, if you have ₹100 today, it could grow if you invest it, while the same ₹100 in the future does not have the same earning potential.

Examples & Analogies

Imagine you have ₹10,000 today. If you invest it in a savings account that earns 5% interest annually, after one year, you'll have ₹10,500. However, if someone promises to give you ₹10,000 a year from now, you will lose out on that interest. Hence, the money you possess now holds more value.

Reasons for Time Value of Money

Chapter 2 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Reasons for TVM include inflation (which reduces purchasing power), opportunity cost (the potential returns from investing today), and risk and uncertainty (present money is guaranteed, while future money is uncertain).

Detailed Explanation

Three primary reasons underpin the concept of the Time Value of Money: first, inflation decreases the amount of goods or services you can buy with money over time. Second, if you have money today, you can invest it or use it to earn returns. Lastly, there's an inherent risk with future money; it could be less due to various unforeseen circumstances.

Examples & Analogies

Consider inflation like a 'money thief' that sneakily reduces your wealth. If a loaf of bread costs ₹30 today, due to inflation, it might cost ₹35 a year from now. In terms of opportunity cost, think about winning a ₹1,000 lottery. If you do nothing with it, that money remains stagnant and loses value over time due to inflation, making it less worth it when you try to spend it.

Components Influencing Time Value of Money

Chapter 3 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The key components that influence TVM are Principal (P), Interest rate (r or i), Time period (t or n), and Frequency of compounding.

Detailed Explanation

To fully understand the Time Value of Money, we should look at four essential components: The Principal (P) is the starting amount of money invested or borrowed. The Interest rate (r) is how much that money will grow per period. The Time period (t) indicates for how long the money will be invested or borrowed. Finally, the Frequency of compounding tells us how often the interest is added to the principal, influencing overall earnings.

Examples & Analogies

Think of the Principal as the seeds you plant in a garden. The Interest rate is akin to the garden's sunlight—higher sunlight helps produce more fruits. Time periods represent seasons—longer growth times often yield a greater harvest. Compounding frequency is like watering your plants more often: the more you water (or compound interests), the more your plants grow.

Types of Interest

Chapter 4 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Types of interest include Simple Interest (calculated on the principal only) and Compound Interest (calculated on principal plus accumulated interest).

Detailed Explanation

There are two main types of interest: Simple Interest, which only considers the initial principal amount, and Compound Interest, which accounts for interest on both the principal and previously accrued interest. This distinction is crucial as Compound Interest tends to generate significantly more money over time than Simple Interest.

Examples & Analogies

Imagining a savings account, Simple Interest is like a flat fee; you might earn a fixed amount on your original balance every year. In contrast, Compound Interest is like an ever-growing snowball: as it rolls down a hill (or the years go by), it gathers more snow (or interest) since it grows based on its own previous size.

Future Value and Present Value

Chapter 5 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Future Value (FV) is the value of current money at a future date, while Present Value (PV) is the current worth of money to be received in the future.

Detailed Explanation

Future Value (FV) calculates how much an amount of money today will grow over time at a given interest rate, considering the principle and the compounding effect. In contrast, Present Value (PV) determines what future cash flows are worth in today’s terms. This is an essential concept for making financial decisions, evaluating investments, or determining the worth of future cash inflows.

Examples & Analogies

If you plan to receive ₹10,000 in five years, the PV tells you what that future ₹10,000 is worth today if invested. Conversely, if you invest ₹1,000 today at 10% for five years, FV will tell you how much that investment will yield in the future, demonstrating the power of investing today.

Applications of Time Value of Money in Business and Tech Startups

Chapter 6 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

TVM applies in various fields including Capital Budgeting, Loan Amortization, Valuation of Investments, Startup Planning, and Software Cost Justification.

Detailed Explanation

Understanding the Time Value of Money is essential for making strategic financial decisions in business. In Capital Budgeting, it helps evaluate whether the projected returns from a project justify the investment costs. Loan Amortization applies TVM principles to determine monthly payments (EMIs). Startups can use it to understand funding needs and project break-even points effectively.

Examples & Analogies

Picture a tech startup asking for investors. Using TVM, they can justify their funding request by showing potential future earnings against the financial backing needed today. It's akin to potential customers valuing a subscription service's present benefits versus future costs.

Key Concepts

-

Time Value of Money (TVM): The principle that money available today is worth more than the same amount in the future due to its earning potential.

-

Principal: The initial amount of money invested or borrowed.

-

Interest Rate: The percentage at which money grows, impacting both simple and compound interest calculations.

-

Future Value (FV): The value of an investment at a specified date in the future based on its growth rate.

-

Present Value (PV): The current worth of a future sum of money, reflecting its diminishing value over time.

-

Annuities: Fixed payments made at regular intervals, used in financial planning.

-

Discounted Cash Flow (DCF): A method for valuing investments based on future cash flows, discounted back to present value.

Examples & Applications

If you invest ₹10,000 today at an interest rate of 5%, in 5 years, the future value using simple interest would be FV = 10,000 * 0.05 * 5 = ₹12,500.

To calculate the future value of ₹10,000 at 5% interest compounded annually for 5 years, FV = 10,000 * (1 + 0.05)^5 = ₹12,763.36.

If you plan to receive ₹50,000 in 10 years at a discount rate of 3%, the present value would be PV = 50,000 / (1 + 0.03)^10 = ₹37,973.62.

For an annuity due of ₹1,000 paid annually for 5 years at an interest rate of 4%, PV can be calculated using the PVA formula.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To save and earn, give it time, with interest you will climb and climb.

Stories

Once there was a penny that wanted to grow. It found a bank and learned to compound, and before it knew it, it became a dollar!

Memory Tools

Remember 'PIT' for the key components: Principal, Interest, Time.

Acronyms

Use 'FREED' to remember

Future Results Equal Earnings Daily.

Flash Cards

Glossary

- Time Value of Money (TVM)

The principle that money available today is worth more than the same amount in the future due to its potential earning capacity.

- Principal

The original amount of money invested or borrowed.

- Interest Rate

The rate at which money grows over time; can be expressed as a percentage.

- Compounding

The process of earning interest on previously earned interest.

- Future Value (FV)

The value of current money at a future date, accounting for interest earnings.

- Present Value (PV)

The current worth of a sum of money to be received in the future.

- Annuity

A series of equal payments made at regular intervals.

- Discounted Cash Flow (DCF)

A valuation method that estimates the attractiveness of an investment using TVM.

- Internal Rate of Return (IRR)

The discount rate at which the net present value (NPV) of an investment equals zero.

Reference links

Supplementary resources to enhance your learning experience.