Internal Rate of Return (IRR)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding IRR

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we’ll explore the Internal Rate of Return, or IRR. Simply put, IRR is the discount rate at which the net present value of an investment equals zero. Can anyone explain why this concept is crucial for evaluating investments?

It helps determine if a project is worth investing in based on whether it meets the required rate of return or not.

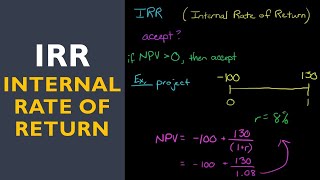

So, if IRR is greater than my expected return, I should go ahead with the project?

Exactly! Remember the phrase 'higher IRR, higher acceptance' to help you recall that. Now, who can summarize how IRR is used in practical scenarios?

We use it to compare different investment opportunities and choose the best one.

Great summary! IRR allows us to measure and compare the profitability of investments.

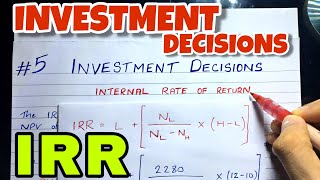

Components of IRR Calculation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s dive deeper into how IRR is actually calculated. The calculation requires cash flow projections for the investment. Who can tell me what these cash flows typically include?

They would include all expected returns and outflows associated with the project.

Correct! It’s essential to have accurate cash flow estimates. To make sure it sticks, what can we use if we have fluctuating cash flows?

We could use trial and error or IRR functions on calculators and software for different rates.

Absolutely! Calculating IRR can be complex when cash flows change over time. Just remember the cash flows and your discount rates!

Comparing IRR with Required Return

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Understanding the IRR is crucial, but how do we decide if we should proceed with a project based on it?

If the IRR is greater than the required return, we should accept the project.

But if it’s less, we should reject it, right?

Exactly! This approach ensures that we only invest in projects that generate adequate returns compared to their risks. Can you think of an example where you might have to use IRR in the real world?

When evaluating startup funding or deciding on projects in a tech company.

Perfect! Remember, the IRR is a powerful tool. Just keep 'IRR above required return' in mind!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

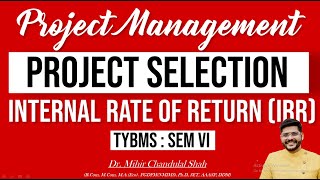

This section emphasizes the significance of IRR as a critical metric for assessing investment profitability. It outlines how IRR is used to determine whether to accept or reject projects based on the comparison between IRR and the required return rate.

Detailed

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is defined as the discount rate that makes the Net Present Value (NPV) of an investment or a project equal to zero. Essentially, it represents the break-even rate of return that a project must achieve in order to be considered worthwhile. When comparing projects, if the calculated IRR exceeds the predetermined required rate of return, the project can be accepted.

In practical terms, the IRR can be especially useful in capital budgeting and investment analysis, as it allows investors to gauge profitability against the cost of capital or returns expected from different investment opportunities. By employing IRR, companies can prioritize their investments efficiently, ensuring that funds are allocated to the most promising projects.

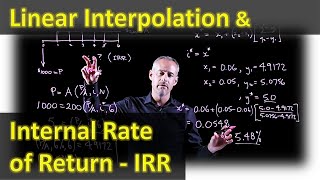

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of IRR

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The discount rate at which NPV = 0. It’s used to assess the profitability of investments.

Detailed Explanation

The Internal Rate of Return (IRR) is essentially the rate of return at which an investment's net present value (NPV) equals zero. This means that at this rate, the present value of cash inflows from the investment is equal to the present value of cash outflows. The IRR helps investors understand at what rate an investment will break even in terms of profitability.

Examples & Analogies

Imagine you're considering investing in a small coffee shop. If you find that the IRR of this investment is 8%, it means that if you can earn an alternate investment return of more than 8% elsewhere, you might want to consider that option instead, because your coffee shop is only as attractive as the IRR it offers.

Decision Rule for IRR

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

If IRR > required return → Accept project

Detailed Explanation

The decision-making process based on IRR involves comparing the IRR to a predetermined required rate of return. If the calculated IRR for a project is greater than the required return (often based on the cost of capital or other investment opportunities), it suggests that the project is likely to be profitable, and hence, accepting the project would be a wise financial choice.

Examples & Analogies

Think of it like deciding whether to buy a new phone. If the phone has features that add value to you that justify the high price tag, you'll buy it. But if a cheaper model offers similar features at a lower price point, you'd consider that instead. Similarly, if a project's IRR is higher than your accepted investment standard, you're more inclined to invest.

Using IRR in Comparison

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Used in comparison with DCF

Detailed Explanation

IRR is often used in conjunction with Discounted Cash Flow (DCF) analysis when evaluating multiple investment opportunities. While DCF provides an assessment of the value of an investment based on expected future cash flows, IRR helps to summarize these evaluations by providing a single rate of return percentage for quick comparison. Investors assess IRR relative to other potential investments to determine the most favorable option.

Examples & Analogies

Consider you're trying to choose between two job offers. Offer A has a higher salary but less job satisfaction, while Offer B pays less but aligns perfectly with your career goals. Analyzing each offer using metrics like salary (like DCF) helps you evaluate them numerically, while your overall career satisfaction might influence your 'IRR', guiding your decision.

Key Concepts

-

Internal Rate of Return (IRR): The discount rate at which the NPV equals zero, indicating the profitability of an investment.

-

Net Present Value (NPV): The present value of cash inflows minus cash outflows.

-

Cash Flow: Monetary inflows and outflows related to a project or investment.

-

Decision Rule: Accept projects with IRR greater than the required return.

Examples & Applications

If an investment generates cash flows of ₹1000 in Year 1, ₹2000 in Year 2, and ₹3000 in Year 3, and the initial investment is ₹4500, the IRR can be calculated to determine its worth.

A project requiring a 10% return has an IRR of 15%. This means it exceeds expectations and would be acceptable.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

If the IRR shines bright, the project feels just right!

Stories

Imagine a traveler seeking the best route. Each path represents an investment, and only the road with the IRR above the threshold is worth taking.

Memory Tools

Remember: IRR = I Rate of Returns that matters!

Acronyms

IRR

In Review

Remember Returns.

Flash Cards

Glossary

- Internal Rate of Return (IRR)

The discount rate at which the Net Present Value (NPV) of an investment is zero.

- Net Present Value (NPV)

The difference between the present value of cash inflows and outflows over time.

- Cash Flow

The total amount of money being transferred into and out of a business.

- Discount Rate

The interest rate used to discount future cash flows to their present value.

Reference links

Supplementary resources to enhance your learning experience.