Current Ratio Formula

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Current Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss the Current Ratio, which is a vital liquidity measure in financial analysis. Can anyone tell me what we mean by liquidity?

Isn’t liquidity about how easily a company can cover its short-term debts?

Exactly! The Current Ratio helps us understand that better. The formula is Current Assets divided by Current Liabilities. We’ll come back to that, but what do you think an ideal Current Ratio would be?

I think I've heard it's 2 to 1.

Correct! A ratio of 2:1 means that a company has twice as many current assets as it has current liabilities. Why do you think that’s advantageous?

It would mean the company is in a good position to pay its short-term obligations!

Absolutely! Let's keep that in mind as we delve into the calculations.

Calculating the Current Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s calculate the Current Ratio! Imagine a company has current assets of $500,000 and current liabilities of $250,000. How would we find the Current Ratio?

We just divide the assets by the liabilities, right?

Exactly! So what’s the Current Ratio in this case?

That would be 500,000 divided by 250,000, which is 2!

Great job! A Current Ratio of 2 indicates the company can cover its liabilities perfectly. What does it tell us about the company's liquidity?

It suggests strong liquidity!

Right! But remember, a too high ratio might indicate inefficiencies. Always look at the context.

Interpreting Current Ratio Data

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Understanding the Current Ratio is essential, but interpretation is crucial. What can a ratio significantly higher than 2 mean?

It might mean that the company is too conservative and not investing enough in growth?

Great point! Conversely, what if the ratio is below 1?

That would suggest the company might struggle to meet obligations.

Exactly! So, when analyzing firms, always consider both the ratio and the broader financial picture. Can anyone summarize how the Current Ratio affects investment decisions?

Investors might avoid companies with low ratios because they could be at risk of default.

Right! Excellent summary everyone.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Current Ratio is a vital liquidity ratio calculated as Current Assets divided by Current Liabilities. An ideal ratio is typically 2:1, suggesting the company has twice as many current assets as liabilities, providing insight into its short-term financial health.

Detailed

Current Ratio Formula

Overview

The Current Ratio is a key liquidity ratio that gauges a company's ability to meet its short-term obligations. It is calculated by dividing Current Assets by Current Liabilities. A ratio of 2:1 is generally considered ideal, indicating that the company can cover its short-term debts with its current assets effectively.

Significance of the Current Ratio

- Indicator of Financial Health: The current ratio provides stakeholders with crucial information regarding a firm’s financial stability in the short term.

- Decision-Making Tool: It assists management in strategic planning and aids investors and creditors in assessing the firm's risk level.

- Comparative Analysis: Benchmarking this ratio against industry standards can help determine a company’s relative financial position.

In the context of the chapter on financial ratio analysis, understanding the Current Ratio is essential for tech entrepreneurs and managerial roles in tech firms, as it informs them about liquidity and overall financial strategies.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Current Ratio Formula

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

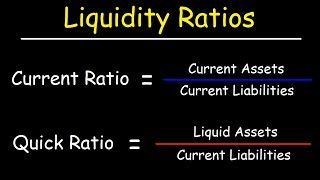

Current Assets

Current Ratio=

Current Liabilities

Detailed Explanation

The Current Ratio is a financial metric that helps assess a company's ability to pay its short-term obligations. It is calculated by dividing the current assets by the current liabilities. Current assets refer to the resources of a company that are expected to be converted to cash or consumed within one year, while current liabilities are obligations due to be paid within the same time frame. A higher ratio indicates better liquidity, meaning the company is less likely to face a cash crunch when its debts come due.

Examples & Analogies

Think of the Current Ratio like a personal budget. If you have $2,000 in the bank (current assets) but owe $1,000 this month (current liabilities), your Current Ratio would be 2:1. This means you have double the money you need to pay off your debts, which is a healthy financial situation.

Ideal Ratio

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Ideal Ratio: 2:1

Interpretation: Indicates whether the company can cover short-term debts with current assets.

Detailed Explanation

The ideal Current Ratio is often considered to be 2:1, meaning that for every dollar of current liabilities, the company should have two dollars in current assets. This level is seen as a comfortable buffer for meeting short-term debts, indicating financial health. If the Current Ratio falls significantly below this benchmark, it raises concerns about the company's ability to meet its obligations, which may lead to financial distress.

Examples & Analogies

Imagine a grocery store that has $200,000 worth of stock (their current assets) and $100,000 in bills to pay (current liabilities). With a Current Ratio of 2:1, the store can easily meet its obligations because it has enough stock, which it can sell quickly to generate cash.

Key Concepts

-

Current Ratio: A ratio measuring liquidity, calculated as Current Assets divided by Current Liabilities.

-

Ideal Ratio: A Current Ratio of 2:1 is typically considered ideal for short-term financial stability.

-

Liquidity: The availability of liquid assets to a company to meet short-term obligations.

Examples & Applications

A company has current assets of $1,000,000 and current liabilities of $500,000. Its Current Ratio is 2.

If a company has $800,000 in current assets but $1,000,000 in current liabilities, its Current Ratio would be 0.8, indicating potential liquidity issues.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When assets are plenty and debts are low, 2:1 is the ratio we should know!

Stories

Imagine a shopkeeper who sells fruits for a living. She keeps a stock of fruits worth $2000, while she owes $1000 to suppliers. She knows her current ratio is 2:1, allowing her peace to continue her business.

Memory Tools

ASSETS > LIABILITIES = GOOD! Remember to keep your assets over liabilities to maintain a strong current ratio!

Acronyms

CLI = Current Liabilities Index; this can remind us to check our current liabilities against assets!

Flash Cards

Glossary

- Current Assets

Assets that are expected to be converted into cash or used up within one year.

- Current Liabilities

Obligations a company must pay within one year.

- Liquidity

A measure of how quickly assets can be converted into cash.

Reference links

Supplementary resources to enhance your learning experience.