Gross Profit Ratio Formula

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Gross Profit

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will start by exploring the concept of Gross Profit. Gross Profit is the revenue left after deducting the cost of goods sold. Can anyone tell me why understanding gross profit is important?

It shows how much money we retain from sales after covering production costs.

Exactly! This measure helps businesses understand profitability—essentially how well they are turning sales into profits. Now, what do we mean by 'Cost of Goods Sold'?

It's the total costs of manufacturing the products that were sold.

Great! Now that we have the basics down, let's move on to how we calculate the Gross Profit Ratio.

Calculating the Gross Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To calculate the Gross Profit Ratio, we use the formula: Gross Profit divided by Net Sales, multiplied by 100. Does anyone remember what Gross Profit is?

It's sales revenue minus the cost of goods sold.

Correct! So if our Gross Profit is $200,000, and our Net Sales are $500,000, how would we calculate the Gross Profit Ratio?

We take $200,000 divided by $500,000, which is 0.4, and then multiply by 100, so it's 40%.

Excellent! This means the company retains 40% of its sales after covering the cost of goods sold. What might this tell a stakeholder?

It indicates efficiency and profitability.

Interpreting the Gross Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand how to calculate the Gross Profit Ratio, let's discuss its significance. Why do you think a high Gross Profit Ratio is preferable?

It suggests that the company has a good pricing strategy and manages its production costs well.

That's right! A higher ratio means more room for other expenses, such as marketing and administration, while maintaining profitability. Can low ratios indicate any issues?

Yes, it might suggest high production costs or pricing issues.

Exactly! Stakeholders can use this ratio to assess overall financial health and operational capabilities. Let's summarize what we learned today.

In summary, the Gross Profit Ratio is essential for assessing efficiency and profitability, helping stakeholders make informed decisions.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section discusses the Gross Profit Ratio formula, which calculates gross profit as a percentage of net sales. It reflects a company's operational efficiency and serves as a critical metric for stakeholders in evaluating a firm's profitability and overall financial performance.

Detailed

Gross Profit Ratio Formula

The Gross Profit Ratio is a crucial profitability metric that demonstrates a company's efficiency in generating profit from its sales. It is calculated using the following formula:

Formula

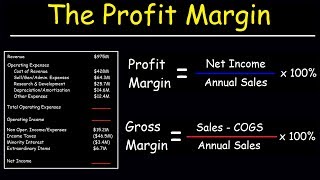

Gross Profit Ratio = (Gross Profit / Net Sales) × 100

- Gross Profit: The difference between net sales and the cost of goods sold (COGS). It indicates the profit a company makes after subtracting the expenses incurred in producing its goods.

- Net Sales: The total revenue from sales of goods or services minus returns, allowances, and discounts.

Interpretation

A higher Gross Profit Ratio indicates better efficiency in production or sourcing, signaling to stakeholders that the company is managing its costs effectively. This ratio is vital for assessing a firm's financial health, especially for management and investors aiming to understand profitability trends and operational efficiency.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Gross Profit Ratio Formula

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Gross Profit

Gross Profit Ratio= ×100

Net Sales

Detailed Explanation

The Gross Profit Ratio formula helps us understand how much profit a company makes after accounting for the costs associated with producing its goods or services. It takes the gross profit, which is calculated as total sales minus the cost of goods sold (COGS), and divides it by net sales. This ratio is then multiplied by 100 to express it as a percentage. A higher gross profit ratio indicates better efficiency in production or sourcing, meaning the company keeps more money from each sale after covering its direct costs.

Examples & Analogies

Imagine you run a bakery. If you sell a cake for $100 but it costs you $60 to bake it (including ingredients and labor), your gross profit is $40. Therefore, your Gross Profit Ratio would be ($40 / $100) × 100 = 40%. This means for every dollar made from sales, you keep 40 cents after covering the direct costs of making that cake.

Interpretation of Gross Profit Ratio

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interpretation: Reflects efficiency in production or sourcing.

Detailed Explanation

The interpretation of the Gross Profit Ratio provides insights into a company's production efficiency and its ability to manage costs. If a company has a high gross profit ratio, it suggests that it is effectively managing its production costs relative to its sales revenue. Conversely, a declining gross profit ratio may signal rising production costs or pricing issues, and could indicate the need for further investigation into operational efficiencies.

Examples & Analogies

Continuing with the bakery example, if you notice that over the last few months your Gross Profit Ratio has decreased from 40% to 30%, it might mean that the prices of your baking ingredients have increased or that you are selling cakes at lower prices. To understand what’s happening, you would want to look at your expenses closely and possibly find more cost-effective suppliers to improve your profit margins.

Key Concepts

-

Gross Profit: Revenue after cost of goods sold.

-

Net Sales: Total revenue from sales minus any returns or allowances.

-

Efficiency: Ability to generate profit from sales.

Examples & Applications

If a company has net sales of $1,000,000 and a gross profit of $400,000, the Gross Profit Ratio is (400,000 / 1,000,000) × 100 = 40%.

If another company demonstrates a Gross Profit Ratio of 60%, it indicates a higher efficiency in converting sales into profits.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To find profit's might, use Gross over Sales bright.

Stories

Imagine a baker selling cookies. If cookies cost $1 to bake and he sells them for $2, his gross profit is $1. The higher the profit, the sweeter the sales!

Memory Tools

Remember GNS: Gross, Net, Sales - for Gross Profit Ratio.

Acronyms

GPR - Gross divided by Net times 100 will get you there!

Flash Cards

Reference links

Supplementary resources to enhance your learning experience.