Debtors Turnover Ratio Formula

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to the Debtors Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we are going to explore the Debtors Turnover Ratio. Can anyone tell me what they think this ratio signifies?

Isn’t it about how quickly a company collects payments from its customers?

Exactly, great observation! The Debtors Turnover Ratio measures how efficiently a company collects receivables from its credit customers. The formula is Net Credit Sales divided by Average Accounts Receivable.

So, what does a high or low ratio mean?

A high ratio indicates effective collection policies and efficient operations. In contrast, a low ratio could mean a company might be struggling to collect payments.

What is considered a good Debtors Turnover Ratio?

That's an important question! It varies by industry, so there isn’t a one-size-fits-all answer. However, companies typically aim for a higher ratio to signify efficiency.

In summary, the Debtors Turnover Ratio is crucial for assessing credit policies and cash flow management. It helps stakeholders make informed decisions.

Calculating Debtors Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s go through a calculation example. Assume a company has Net Credit Sales of $500,000 and Average Accounts Receivable of $100,000. Can anyone calculate the Debtors Turnover Ratio?

That would be $500,000 divided by $100,000, which equals 5.

Correct! This means the company turns over its receivables 5 times a year. How might an investor interpret this?

They'd see that the company is relatively good at collecting its debts.

Exactly! This information is essential for understanding the firm's liquidity as well as efficiency. Can anyone think of any limitations of relying solely on this ratio for assessing company health?

It might not show the whole picture if the business has seasonal sales or fluctuating credit policies.

Good insight! You’re right; it’s vital to consider other financial ratios and context when evaluating a company’s performance.

Practical Implications of the Debtors Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss the practical implications of the Debtors Turnover Ratio. How might companies use this ratio to improve operations?

They could use it to spot long-term issues in credit management or to adjust their collection processes.

Exactly! Additionally, by comparing their ratio with industry benchmarks, businesses can identify if they’re lagging behind their peers.

Are there any strategies companies could adopt to improve their turnover ratio?

Certainly! Companies can streamline billing processes, offer incentives for early payments, or improve credit policies. In conclusion, understanding and effectively managing the Debtors Turnover Ratio is crucial for cash flow and operational efficiency.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section focuses on the Debtors Turnover Ratio, detailing its formula, interpretation, and practical significance in assessing a company's efficiency in managing credit sales and collecting payments.

Detailed

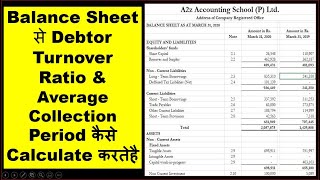

Debtors Turnover Ratio Formula

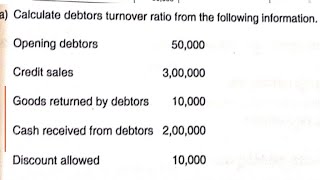

The Debtors Turnover Ratio is a critical measure of a company's efficiency in managing its accounts receivable. It is calculated using the formula:

Debtors Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Key Points:

- Interpretation: A higher ratio indicates efficient collection of receivables and effective credit policies, while a lower ratio may signal issues with collection or credit policies.

- Applications: Understanding this ratio helps stakeholders evaluate the company's liquidity and operational efficiency, which is essential in financial statement analysis.

Youtube Videos

![[5/10] #Ratioanalysis | Debtors Turnover Ratio | Debtors Turnover Period | Solved Numerical Problem](https://img.youtube.com/vi/fKA4KYzu3-E/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Debtors Turnover Ratio Formula Definition

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Debtors Turnover Ratio Formula:

Net Credit Sales

Debtors Turnover Ratio=

Average Accounts Receivable

Detailed Explanation

The Debtors Turnover Ratio measures how efficiently a company collects payments from its customers. The formula consists of dividing the net credit sales (total sales made on credit minus returns) by the average accounts receivable (the average amount owed by customers). This ratio shows the number of times the company collects its average accounts receivable in a given period, typically a year.

Examples & Analogies

Imagine you run a small bakery. If your sales for the year are $120,000, and you allow customers to buy on credit, your average accounts receivable might be $30,000. By calculating the Debtors Turnover Ratio, you would determine how often you collect payments from those customers. A higher ratio indicates that your customers pay you back quickly, much like how your bakery is constantly busy serving customers without delays in payment.

Interpretation of Debtors Turnover Ratio

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interpretation: Indicates how efficiently the company collects receivables.

Detailed Explanation

The interpretation of the Debtors Turnover Ratio revolves around the efficiency of the company's credit policies and its effectiveness in collecting receivables. A higher ratio suggests that the company does an excellent job of collecting debts, which means cash flow is strong. A lower ratio might indicate issues with credit policies or customer payments, potentially leading to cash flow problems.

Examples & Analogies

Consider a retail store that extends credit to its customers. If the store has a Debtors Turnover Ratio of 10, it means they collect their receivables 10 times a year. This is a positive sign, indicating good cash flow management. If another store has a ratio of 3, it suggests they may need to reconsider their credit terms or improve their collection processes to avoid cash flow issues.

Importance of Debtors Turnover Ratio in Business

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Importance: Helps assess credit management efficiency and impacts cash flow.

Detailed Explanation

The Debtors Turnover Ratio is crucial for understanding a business's credit management efficiency. It impacts cash flow directly since timely collections from customers ensure that the business has sufficient cash to operate daily. By monitoring this ratio, businesses can make informed decisions regarding credit policies and customer relationships, leading to more effective cash flow management.

Examples & Analogies

Think of a small coffee shop that sells on credit during busy hours to regular customers. By watching the Debtors Turnover Ratio, the shop owner notices that customers are not paying back within the expected timeframe. To ensure that the shop stays operational without cash shortages, the owner decides to only allow credit sales to reliable customers and starts offering discounts for immediate payments. This adjustment not only improves cash flow but also enhances customer loyalty.

Key Concepts

-

Debtors Turnover Ratio: A measure of how efficiently a company collects its receivables.

-

Net Credit Sales: Total sales made on credit after deductions.

-

Average Accounts Receivable: The typical amount owed to a company by its customers.

Examples & Applications

If a company reports net credit sales of $800,000 and its average accounts receivable is $200,000, then its Debtors Turnover Ratio would be 4, indicating it collects its receivables four times a year.

A retail store with a high Debtors Turnover Ratio may indicate that it practices effective credit management, leading to a strong cash flow.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Debtors Turnover, in a jiffy, collects cash and keeps it spiffy.

Stories

Once upon a time, a wise merchant knew that collecting debts early made her business thrive. The quicker she turned her receivables, the richer she became!

Memory Tools

Remember 'DAC': Debtors, Average Receivables, Credit Sales for calculating the Debtors Turnover Ratio.

Acronyms

DTR = Debt Collection's True Rate.

Flash Cards

Glossary

- Debtors Turnover Ratio

A financial ratio that measures how efficiently a company collects its outstanding credit sales.

- Net Credit Sales

Sales made on credit excluding returns, allowances, and discounts.

- Average Accounts Receivable

The average amount of money owed by customers, calculated by averaging the beginning and ending balances of accounts receivable.

Reference links

Supplementary resources to enhance your learning experience.