Net Profit Ratio Formula

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Profitability Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we're diving into profitability ratios, specifically the Net Profit Ratio. This ratio tells us how profitable a company is relative to its sales. Can anyone explain what profitability means?

I think it means how much profit we make compared to our expenses!

Exactly! Profitability is all about seeing how effectively a company converts its revenues into profit. The Net Profit Ratio will give us a clear picture of that. Remember the formula: Net Profit divided by Net Sales times 100. Does anyone know why this ratio is important?

It helps investors understand how well a company is doing financially!

Absolutely! A higher ratio indicates more efficiency. So, keep in mind the acronym PEE: Profit (Net Profit), Efficiency (ratio indicates how well the company uses its sales), and Evaluation (helps stakeholders evaluate the company).

Calculating the Net Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s calculate the Net Profit Ratio using an example. If a company has a net profit of $200,000 and net sales of $1,000,000, how would we calculate it?

I think we divide $200,000 by $1,000,000, and then multiply by 100?

Correct! So what would the calculation look like?

It would be (200,000 / 1,000,000) times 100, which equals 20%!

Great job! This means the Net Profit Ratio is 20%, meaning the company earns 20 cents for every dollar of sales after expenses. Let's remember the mnemonic 'SPARE' – Sales, Profit, All (expenses), Ratio, Evaluate. This will help us remember each step to get the net profit ratio!

Interpreting the Net Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know how to calculate the Net Profit Ratio, let’s talk about what it means. If a company's Net Profit Ratio is 10%, what does that tell us?

It’s suggesting that they are not making much profit from their sales, right?

Exactly! A lower ratio can indicate high expenses or potential inefficiencies. What about a ratio of 30%?

That would mean the company is doing really well, earning a lot more profit!

Correct! High ratios are typically favorable. To help memorize these interpretations, let's use the acronym CREAM: Comparison, Revenue, Earnings, Analysis, Meaning. This can help reinforce what each ratio signifies.

Limitations of the Net Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s wrap up by discussing some limitations of the Net Profit Ratio. Why do you think it’s not the only thing we should rely on?

Because it doesn't show how a company is doing in terms of liquidity or solvency.

That's right! It mainly focuses on profitability. Other factors, like market conditions and industry standards, also affect a company's performance. Remember the acronym LIST: Limitations, Industry context, Scalability, Trends. This will help remind us that context is necessary when analyzing ratios.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

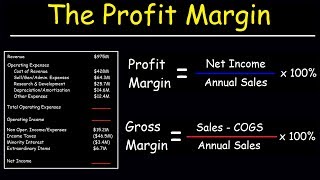

The Net Profit Ratio, calculated as Net Profit divided by Net Sales multiplied by 100, reflects a company’s profitability after all expenses. It is crucial for evaluating financial health and effectiveness in generating profit from revenues.

Detailed

Net Profit Ratio Formula

The Net Profit Ratio is a critical profitability ratio in financial analysis that indicates how much profit a company makes for every dollar of sales, after all expenses have been deducted. The formula is:

Net Profit Ratio = (Net Profit / Net Sales) × 100

This ratio provides insights into a company's overall profitability, informing stakeholders about its efficiency in converting sales into actual profit. A higher net profit ratio signifies better profitability and operational efficiency, making it a useful tool for investors and managers alike in assessing company performance.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Net Profit Ratio Formula Definition

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Net Profit Ratio Formula:

Net Profit

Net Profit Ratio= ×100

Net Sales

Detailed Explanation

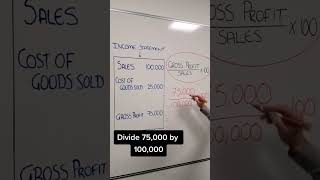

The Net Profit Ratio is calculated by dividing the net profit of a company by its net sales, and then multiplying the result by 100 to express it as a percentage. This ratio helps to measure how effectively a company is converting sales revenue into actual profit after all expenses, including operating costs, taxes, and interest, have been deducted. The formula is expressed as:

\[ \text{Net Profit Ratio} = \left( \frac{\text{Net Profit}}{\text{Net Sales}} \right) \times 100 \]

This means if you know the net profit (how much money the company actually makes) and the total sales revenue (how much money the company brings in from selling its products or services), you can easily determine how much of each dollar earned results in profit.

Examples & Analogies

Imagine a lemonade stand. If you sell lemonade for $100 in total (your net sales), but after accounting for the cost of lemons, sugar, cups, and also your own time (your expenses), you end up with $20 in profit (your net profit). If you calculate your Net Profit Ratio, you'll do this:

\[ \text{Net Profit Ratio} = \left( \frac{20}{100} \right) \times 100 = 20\% \]

This means that 20% of your sales revenue is profit, which gives you an idea of how profitable your lemonade stand is after covering all costs.

Interpretation of Net Profit Ratio

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interpretation: Indicates overall profitability after all expenses.

Detailed Explanation

The interpretation of the Net Profit Ratio provides valuable insight into a company's profitability. A higher Net Profit Ratio indicates that a larger portion of revenue is being retained as profit, signaling effective cost management and strong pricing strategies. Conversely, a lower ratio may suggest that the company is struggling with high costs or low sales prices, meaning it is less efficient at converting sales into profits.

Examples & Analogies

Consider two competing coffee shops:

- Shop A has a Net Profit Ratio of 30%, while Shop B has a ratio of 10%.

This indicates that Shop A retains 30 cents from every dollar of sales as profit, suggesting it has better control over its expenses and pricing strategy. On the other hand, Shop B only retains 10 cents, which implies it might need to improve its operational efficiency or find ways to increase its sales prices without losing customers.

Key Concepts

-

Net Profit Ratio: A ratio that indicates overall profitability after all expenses.

-

Calculation: (Net Profit / Net Sales) × 100.

-

Interpretation: A higher ratio implies better overall profitability.

Examples & Applications

If a company has a net profit of $300,000 and net sales of $1,200,000, the Net Profit Ratio is (300,000 / 1,200,000) × 100 = 25%.

A company reporting a Net Profit Ratio of 15% may indicate it has higher operational costs than its competitors.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Profit from each sale, the measure we unveil; Ratio makes it clear, efficiency to cheer.

Stories

Imagine a bakery selling bread; each loaf brings in $10. After costs, $4 is profit. Their ratio is (4/10) x 100 = 40%. This reflects their efficiency in turning sales into profit!

Memory Tools

SPARE: Sales, Profit, All (expenses), Ratio, Evaluate - remember the steps to find net profit!

Acronyms

CREAM

Comparison (to competitors)

Revenue (focus)

Earnings (after expenses)

Analysis (of efficiency)

Meaning (of the results).

Flash Cards

Glossary

- Net Profit

The total revenue minus total expenses, taxes, and costs.

- Net Sales

Total sales revenue minus returns, allowances, and discounts.

- Profitability Ratio

A measure used to assess a company's ability to generate profit relative to its revenue.

Reference links

Supplementary resources to enhance your learning experience.