Quick Ratio (Acid Test Ratio)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Quick Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss the Quick Ratio, sometimes referred to as the Acid Test Ratio. Who can tell me why liquidity is important for a business?

Liquidity is crucial because it shows if the company can meet its short-term obligations.

Correct! The Quick Ratio specifically measures this by considering the most liquid assets, which leads us to our formula. Can anyone explain the formula?

It’s Current Assets minus Inventory divided by Current Liabilities!

Exactly! So, why do we subtract inventory? Think about how easy it is to convert different assets into cash.

Inventory might not be sold quickly, so it’s less reliable than cash or receivables.

Precisely! That's why the Quick Ratio is a stricter measure. To remember this, think of 'Quick' as referring to things that can be turned to cash 'quickly'.

In summary, the Quick Ratio indicates a company's ability to meet obligations without selling inventory. An ideal ratio is 1:1.

Calculating the Quick Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s calculate a Quick Ratio together. If a company has Current Assets of $500,000, Inventory of $150,000, and Current Liabilities of $400,000, what is the Quick Ratio?

First, we'll subtract Inventory from Current Assets: $500,000 - $150,000 equals $350,000.

Great! Now, what do we do with that number?

We divide it by Current Liabilities, so $350,000 divided by $400,000.

Right! What does that give us?

That would be 0.875!

Exactly! Now, how do we interpret that number?

It’s below 1, indicating the company might have some liquidity issues since it can’t fully cover its short-term liabilities just with liquid assets.

Correct! It’s crucial to assess ratios in context. Well done!

Applications of the Quick Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss how businesses use the Quick Ratio. Why might a company care about this ratio when seeking investors?

Investors want to make sure the company can handle its short-term liabilities before putting money in.

Correct! A strong Quick Ratio can attract investment. What about a company’s relationship with creditors?

A better Quick Ratio might encourage creditors to lend money, proving the business can pay its debts.

Exactly! Now, let’s discuss industries. How might the Quick Ratio differ across sectors?

In retail, higher inventory is common, so their Quick Ratios might often be lower compared to service-oriented businesses.

Very good! Context is vital. Can you summarize what we learned today about the Quick Ratio?

The Quick Ratio measures liquidity without relying on inventory, is calculated as a fraction, is crucial for investment and credit evaluations, and varies across industries.

Perfect summary! Remember that the Quick Ratio is an essential financial metric to understand a firm’s liquidity.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

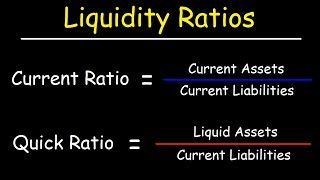

The Quick Ratio is calculated by subtracting inventory from current assets and dividing by current liabilities. It is a stricter measure of liquidity compared to the current ratio, with an ideal benchmark of 1:1, indicating that a company can cover its short-term liabilities with its liquid assets.

Detailed

Quick Ratio (Acid Test Ratio)

The Quick Ratio, often termed the Acid Test Ratio, is a crucial liquidity ratio used in financial analysis to determine a company's short-term financial health. It is calculated using the formula:

Formula

\[ Quick ext{ Ratio} = \frac{Current ext{ Assets} - Inventory}{Current ext{ Liabilities}} \]

Ideal Ratio

- Ideal Ratio: 1:1

- This ratio suggests that the company has at least one dollar in liquid assets for every dollar of current liabilities.

Interpretation

- The Quick Ratio offers a stricter assessment of a company's ability to pay off its current liabilities without the need to sell inventory. In contrast to the Current Ratio, which considers all current assets, the Quick Ratio excludes inventory, a less liquid asset that may not be quickly converted to cash. This makes the Quick Ratio a preferred measure for evaluating financial stability, especially in industries where inventory does not rapidly convert into cash.

Importance

- The Quick Ratio is significant as it provides stakeholders—ranging from investors to managers—with insights into the firm's operational liquidity and short-term financial health. A ratio below 1 may indicate potential liquidity problems, while a ratio above 1 generally signifies good liquidity, assuring stakeholders of the company's ability to meet its short-term obligations.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Quick Ratio Formula

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

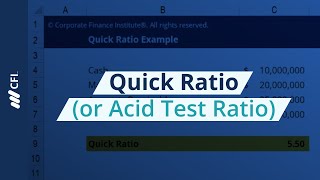

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Detailed Explanation

The Quick Ratio, also known as the Acid Test Ratio, measures a company's short-term liquidity. Specifically, it assesses how well a firm can meet its short-term obligations without relying on the sale of inventory. The formula subtracts inventory from current assets and then divides by current liabilities to give a clear picture of financial health.

Examples & Analogies

Imagine a restaurant that has various dishes (current assets), but most of their raw ingredients (inventory) are not ready to serve. If customers come in and order food (liabilities), the restaurant needs to assess how quickly it can convert its ready-to-serve dishes to fulfill the orders without waiting for the ingredients to be cooked. The Quick Ratio tells the restaurant how prepared it is to handle customer demands without relying on its stock that isn't immediately usable.

Ideal Quick Ratio

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Ideal Ratio: 1:1

Detailed Explanation

An ideal Quick Ratio of 1:1 indicates that for every dollar of current liabilities, the company has a dollar in liquid assets available to cover those liabilities. This ratio is considered a minimum threshold; it signifies that the company is in a position to pay its short-term debts without needing to sell off inventory, reflecting a stronger liquidity position.

Examples & Analogies

Think of it as if you had $1,000 in cash (liquid assets) and $1,000 in bills (current liabilities). You can settle all your bills immediately with the cash you have, which is a comfortable and ideal personal financial situation. If your cash was only $800, you'd have to either borrow money or liquidate some invested resources to clear your debts, not ideal!

Interpretation of the Quick Ratio

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interpretation: Stricter test of liquidity, excludes inventory.

Detailed Explanation

The Quick Ratio excludes inventory from the calculation because inventory may not be as liquid as other current assets. This means that in times of financial stress, a company might struggle to quickly sell inventory to obtain cash. Therefore, a higher Quick Ratio is preferable, as it shows a stronger ability to pay off liabilities using readily available assets.

Examples & Analogies

Imagine a business that sells handcrafted jewelry. While it has a lot of beautiful pieces (inventory), those pieces might take time to sell. If a sudden expense arises—like a broken machine—having cash on hand (cash and receivables) is critical. If this business has a Quick Ratio higher than 1, it signifies that it could meet those urgent expenses without relying on selling jewelry, which might take time.

Key Concepts

-

Quick Ratio: A key liquidity measure that excludes inventory from current assets.

-

Ideal Ratio: 1:1, indicating that a company can adequately cover its short-term debts.

-

Liquidity Importance: A critical factor for businesses in making financial decisions.

Examples & Applications

If a company has $300,000 in current assets, $100,000 in inventory, and $250,000 in current liabilities, the Quick Ratio would be \( \frac{300,000 - 100,000}{250,000} = 0.8 \).

Consider two companies: Company A with a Quick Ratio of 1.5 and Company B with 0.9. Company A is better positioned to handle short-term obligations.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Quick Ratio's slick, shows liquidity quick; take inventory out, solve the doubt!

Stories

Imagine a merchant with plenty of goods (inventory) at hand but can't pay his suppliers. He needs to know his cash is king—so he looks at his Quick Ratio to assess his true liquidity!

Memory Tools

L.A.C. - Look at Assets Minus Current liabilities to remember the Quick Ratio formula.

Acronyms

QRA - Quick Ratio Assessment helps remember what we need to track for short-term liquidity.

Flash Cards

Glossary

- Quick Ratio

A liquidity ratio that measures a company's ability to meet its short-term obligations excluding inventory.

- Liquidity

The ability of a company to meet its short-term financial obligations.

- Current Assets

Assets that are expected to be converted into cash within one year.

- Current Liabilities

Obligations that the company expects to settle within one year.

- Inventory

The goods and materials a business holds for the purpose of resale.

Reference links

Supplementary resources to enhance your learning experience.