Inventory Turnover Ratio Formula

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Inventory Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the Inventory Turnover Ratio. Does anyone know what this ratio signifies?

Is it about how many times we sell inventory?

Exactly! The ratio indicates how often a company sells and replaces its stock of goods during a period, calculated by dividing the Cost of Goods Sold by the Average Inventory.

Why is it important for a business?

Good question! A higher turnover ratio can indicate effective sales and inventory management, while a lower ratio might alert a company to potential issues in sales or overstocking.

So, if I sell my inventory faster, I have a higher ratio?

That's correct! Just remember the formula: ITR = COGS / Average Inventory. Let's keep this in mind as we explore further!

Components of the Inventory Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's break down the components. What do we mean by Cost of Goods Sold?

Is it the total cost of making the products we sell?

Yes! COGS includes all the costs related to producing the items sold, including materials and labor costs. And what about Average Inventory?

Is it the starting and ending inventory averaged out?

Correct! Average Inventory is typically calculated as (Beginning Inventory + Ending Inventory) / 2. This gives a better picture of inventory levels over a period.

Got it! So, both those figures are important for the ratio, but isn't it accurate?

That's a good point! The accuracy of the ITR depends on accurate accounting of COGS and inventory. We'll discuss how to interpret this number next.

Interpreting the Inventory Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

What do you think a high inventory turnover ratio indicates, then?

It means we’re selling inventory quickly, right?

Exactly! A high ratio indicates strong sales or efficient inventory management. Conversely, what might a low ratio suggest?

Maybe we have too much inventory or slower sales?

Correct! Businesses must balance maintaining enough inventory to meet demand while avoiding excess stock that might not sell. Distinguishing between industry norms is also important.

So, it can vary across different industries?

Yes! Each sector has its specific inventory turnover norms. Always compare within the same industry to gauge efficiency.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

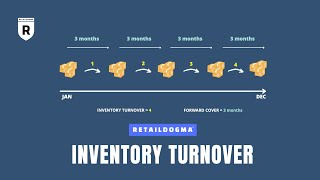

The inventory turnover ratio formula relates the cost of goods sold to the average inventory held by a company between two periods, indicating how quickly inventory is sold. A higher ratio suggests efficient inventory management.

Detailed

Inventory Turnover Ratio Formula

The Inventory Turnover Ratio (ITR) is a financial metric that evaluates how efficiently a company manages its inventory by measuring how many times the inventory is sold and replaced over a specific period. It is calculated using the formula:

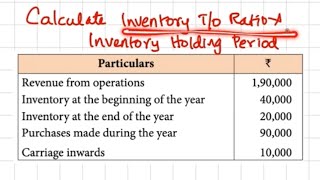

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Key Points:

- Cost of Goods Sold (COGS): This represents the direct costs attributable to the production of the goods sold by the company during a certain period.

- Average Inventory: This can be calculated by adding the beginning inventory and ending inventory for a period and dividing by two.

- Interpretation: A higher inventory turnover ratio indicates efficient management of inventory, suggesting that a company is good at converting its inventory into sales. Conversely, a low ratio may indicate overstocking or underperforming sales.

Understanding the inventory turnover ratio is crucial for stakeholders, especially in sectors where inventory management directly influences profitability.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Inventory Turnover Ratio Formula

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Detailed Explanation

The Inventory Turnover Ratio is a financial metric that indicates how many times a company sells and replaces its inventory over a certain period, usually a year. The formula for this ratio divides the Cost of Goods Sold (COGS) by the Average Inventory. COGS is the total of all direct costs associated with producing goods sold by a company during a specific period. Average Inventory is calculated by adding the beginning inventory to the ending inventory for the period and then dividing by two. This ratio helps businesses understand how efficiently they are managing their inventory.

Examples & Analogies

Imagine a bakery that bakes a specific number of loaves of bread each day. If the bakery sells 10,000 loaves over a year and has an average inventory of 1,000 loaves, the inventory turnover ratio would be 10. This means the bakery completely sold out its inventory 10 times in a year, suggesting that it effectively manages its stock and meets customer demand. Conversely, if the ratio were low, it would indicate excess inventory sitting on the shelves, potentially leading to waste or spoilage.

Interpretation of Inventory Turnover Ratio

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Measures how quickly inventory is sold.

Detailed Explanation

The primary interpretation of the Inventory Turnover Ratio is that it shows the speed at which a company can sell its inventory. A higher turnover ratio signifies that a company is selling inventory quickly, which may be a sign of effective inventory management, strong sales, or a high demand for its products. On the other hand, a lower turnover may indicate sluggish sales or overstocking, which could tie up capital and lead to storage costs or markdowns.

Examples & Analogies

Consider a fashion retailer that has a high inventory turnover ratio, meaning it sells its clothing items quickly and regularly stocks new collections. This suggests that customers are buying the latest trends as soon as they arrive. In contrast, if a retailer has a low turnover ratio, it may mean that certain styles are not appealing to customers, leading to a backlog of unsold items taking up space and capital.

Key Concepts

-

Inventory Turnover Ratio: A measure of how efficiently inventory is sold and replaced during a period.

-

Cost of Goods Sold (COGS): Total cost linked to the production of sold goods.

-

Average Inventory: Average amount of inventory over a specific time frame.

Examples & Applications

If a company's COGS for the year is $500,000, and its average inventory is $100,000, the inventory turnover ratio would be 5. This means the company sells its entire inventory five times a year.

In contrast, if a retailer has COGS of $200,000 and an average inventory of $100,000, it has an inventory turnover ratio of 2, indicating slower inventory movement.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To know how fast we sell, look at COGS with inventory as well!

Stories

Imagine a baker who counts sold cakes each day, then he checks his flour stock – that’s how he manages his bakery inventory turnover.

Memory Tools

Remember 'CAV': COGS, Average Inventory, Turnover – the keys to calculating inventory turnover!

Acronyms

ITR

Inventory Turnover Ratio helps track how fast items leave the shelf!

Flash Cards

Glossary

- Cost of Goods Sold (COGS)

The direct costs attributable to the production of the goods sold by the company during a certain period.

- Average Inventory

A calculation representing the average level of inventory held by a firm over a specific period.

- Inventory Turnover Ratio (ITR)

A measure of how quickly a company sells and replaces its inventory over a specific period.

Reference links

Supplementary resources to enhance your learning experience.