Efficiency or Activity Ratios

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Efficiency Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to dive into Efficiency or Activity Ratios. Can anyone share why these ratios are important in financial analysis?

I think they help us see how well a company is using its resources to make money.

Exactly! They reveal how efficiently a company utilizes its assets. Let's start by discussing the first ratio, the Inventory Turnover Ratio.

What's the formula for that?

Great question! The formula is Cost of Goods Sold divided by Average Inventory. Can anyone tell me why a high inventory turnover might be favorable?

It probably means the company is selling its products quickly and not holding too much stock?

Right again! Remember, high turnover indicates efficient management. Let’s summarize. The Inventory Turnover Ratio shows how quickly a company can sell its inventory.

Debtors Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's move on to the Debtors Turnover Ratio. Who can share the formula with the class?

I believe it's Net Credit Sales divided by Average Accounts Receivable!

That's correct! High debtor turnover indicates that a company is collecting its debts more quickly. Why is that a good thing?

It improves cash flow, right?

Exactly! A strong cash flow is critical for operations. Let's all remember: Quick collections = Better cash management.

Total Asset Turnover Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Lastly, let’s look at the Total Asset Turnover Ratio. Can anyone tell me its formula?

It's Net Sales divided by Total Assets!

Correct! This ratio measures how effectively a company uses its assets to generate sales. Why might a high ratio be considered good for a company?

It means the company is making more sales for every dollar of assets it has, right?

Absolutely! This indicates effective resource utilization. To recap, the Total Asset Turnover Ratio reflects asset efficiency in generating sales.

Importance of Efficiency Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know the main efficiency ratios, why do you think they might matter for companies in real life?

They can help identify issues in asset management!

Right! They highlight strengths and weaknesses in asset utilization. In competitive markets, what might be the consequences of poor efficiency ratios?

The company could lose sales and suffer financially.

Correct! Monitoring these ratios regularly can help a firm remain competitive and financially healthy.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Efficiency or Activity Ratios provide crucial insights into a company's operational performance by measuring how effectively it employs its assets to generate sales. Important ratios include Inventory Turnover, Debtors Turnover, and Total Asset Turnover, each of which sheds light on different aspects of asset management.

Detailed

Efficiency or Activity Ratios

Efficiency or Activity Ratios are key financial metrics that evaluate how effectively a firm utilizes its assets to generate sales. These ratios play a critical role in financial analysis as they help stakeholders measure operational efficiency and identify potential areas for improvement. The primary efficiency ratios discussed in this section include:

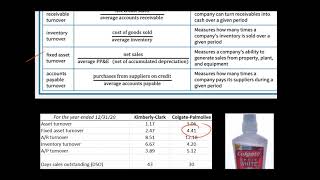

- Inventory Turnover Ratio: This ratio is calculated using the formula Cost of Goods Sold / Average Inventory. It indicates how quickly inventory is sold and replenished. A high turnover ratio suggests efficient inventory management, while a low ratio may imply overstocking or inefficiency.

- Debtors Turnover Ratio: The formula for this ratio is Net Credit Sales / Average Accounts Receivable. It assesses how efficiently a company collects receivables from customers. A higher ratio indicates faster collection of debts, which is favorable for the firm’s cash flow.

- Total Asset Turnover Ratio: This ratio is determined by Net Sales / Total Assets. It measures a firm’s ability to generate sales from its assets. A high total asset turnover ratio indicates effective utilization of assets.

Understanding these ratios allows companies to optimize asset management strategies and enhance overall performance. Given the importance of asset efficiency in competitive markets, these ratios are vital for both internal assessments and external benchmarking.

Youtube Videos

![Activity Ratios [Everything You Need To Know]](https://img.youtube.com/vi/wejcmXZatj0/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Efficiency Ratios

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These ratios evaluate how efficiently a firm uses its assets.

Detailed Explanation

Efficiency or activity ratios measure how well a company utilizes its assets to generate revenue. A higher efficiency ratio indicates that a company is effectively managing its resources. This can affect its profitability and overall financial health.

Examples & Analogies

Think of a delivery truck. If it can deliver goods to more locations with fewer trips, it captures more revenue with less fuel, illustrating efficiency. Similarly, companies that efficiently use their assets can maximize profits within their operational costs.

Inventory Turnover Ratio

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

a) Inventory Turnover Ratio Formula:

Cost of Goods Sold

Inventory Turnover Ratio=

Average Inventory

Interpretation: Measures how quickly inventory is sold.

Detailed Explanation

The Inventory Turnover Ratio calculates how many times a company's inventory is sold and replaced over a period. A higher turnover ratio indicates that inventory is sold rapidly, which means the company is efficient in managing its stock.

Examples & Analogies

Imagine a retail store selling shoes. If the store stocks 100 pairs of shoes and sells them all within a month, it has a high inventory turnover. This means they're popular and the store is doing well. Conversely, if the shoes sit and rarely sell, it's using resources inefficiently.

Debtors Turnover Ratio

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

b) Debtors Turnover Ratio Formula:

Net Credit Sales

Debtors Turnover Ratio=

Average Accounts Receivable

Interpretation: Indicates how efficiently the company collects receivables.

Detailed Explanation

The Debtors Turnover Ratio assesses how quickly a company collects cash from credit sales. It is calculated by dividing net credit sales by average accounts receivable. A higher ratio suggests that the firm is efficient in collecting debts, improving cash flow.

Examples & Analogies

Think of a cafe offering meals on credit. If most customers pay promptly, the cafe has a high debtors turnover. If many customers delay payments, the cafe may face cash flow issues, similar to a bakery needing fast sales to pay for fresh ingredients.

Total Asset Turnover Ratio

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

c) Total Asset Turnover Ratio Formula:

Net Sales

Total Asset Turnover Ratio=

Total Assets

Interpretation: Shows how effectively a firm uses its assets to generate sales.

Detailed Explanation

The Total Asset Turnover Ratio reflects the efficiency of a company in using its total assets to generate sales. This is calculated by dividing net sales by total assets. A higher ratio suggests a more efficient use of assets.

Examples & Analogies

Envision a small tech startup that produces software. If it generates a large revenue relative to its few assets (like computers), it has a high total asset turnover. This means it's leveraging its limited resources effectively to achieve its goals, akin to a small garden producing a bountiful harvest with minimal seeds.

Key Concepts

-

Efficiency Ratios: Metrics that evaluate asset utilization.

-

Inventory Turnover: Indicates sales efficiency of inventory.

-

Debtors Turnover: Assesses speed of debt collection.

-

Total Asset Turnover: Shows asset effectiveness in generating sales.

Examples & Applications

If a company has a cost of goods sold of $500,000 and an average inventory of $100,000, its Inventory Turnover Ratio is 5, indicating it sold its inventory five times in a year.

If a firm reported net sales of $1,000,000 and average total assets of $500,000, its Total Asset Turnover Ratio would be 2, demonstrating effective utilization of assets.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When inventory spins like a wheel, sales it will reveal.

Stories

Imagine a shopkeeper who notes down how fast each of his items sell. The faster they sell, the more money flows in, just like how inventory turnover works!

Memory Tools

To remember the three activity ratios: I (Inventory), D (Debtors), T (Total Assets) - 'IDT it goes well!'

Acronyms

The acronym 'IDEA' for 'Inventory, Debtors, Efficiency in Assets' helps recall key ratios.

Flash Cards

Glossary

- Efficiency Ratios

Ratios that evaluate how efficiently a firm uses its assets.

- Inventory Turnover Ratio

A measure of how quickly a company sells its inventory.

- Debtors Turnover Ratio

A measure of how efficiently a company collects its receivables.

- Total Asset Turnover Ratio

A measure of how effectively a company uses its assets to generate sales.

Reference links

Supplementary resources to enhance your learning experience.