Liquidity Ratios

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Quick Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

The Quick Ratio is a stricter measure of liquidity compared to the Current Ratio. Who can tell me the formula for the Quick Ratio?

It's Current Assets minus Inventory divided by Current Liabilities.

Correct! And why do we exclude inventory?

Because inventory might not be as easily converted to cash in the short term.

Exactly! The ideal Quick Ratio is 1:1. This means a company can meet its short-term obligations with its most liquid assets. How does this help investors?

It shows that the company is not reliant on inventory sales to remain solvent!

Exactly! Investors look for companies with strong liquidity metrics. Can anyone think of what might happen if a tech startup has a low Quick Ratio?

They might struggle to obtain funding or investment!

Correct! Let's wrap this session up by summarizing what we learned about these crucial liquidity ratios.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

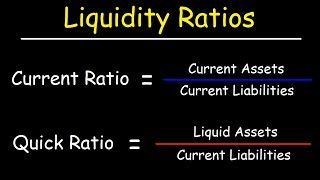

This section delves into liquidity ratios, specifically the current ratio and quick ratio, which are essential for measuring a company's short-term financial health and ability to service immediate debts.

Detailed

Liquidity Ratios

Liquidity ratios are critical financial metrics that evaluate a company's capability to meet its short-term obligations. They provide insights into the company's financial health by determining if current assets are sufficient to cover current liabilities. The two primary liquidity ratios discussed are:

1. Current Ratio: Calculated as Current Assets divided by Current Liabilities, the ideal ratio is 2:1, indicating the company can comfortably cover its short-term debts.

2. Quick Ratio: Also known as the Acid Test Ratio, it refines the current ratio by excluding inventory from current assets. The ideal quick ratio stands at 1:1, reflecting a stricter measure of liquidity. Understanding these ratios is crucial for stakeholders, particularly in tech firms where cash flow dynamics differ.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Overview of Liquidity Ratios

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These ratios measure a firm’s ability to meet short-term obligations.

Detailed Explanation

Liquidity ratios are financial metrics that help assess how well a company can cover its short-term debts using its short-term assets. This is important because it indicates the financial health of a company in the near future. Essentially, a company must have enough cash or cash-equivalent assets (like receivables) to pay off its current liabilities (debts that are due within a year).

Examples & Analogies

Imagine a personal finance scenario. If you have a monthly rent due and money saved in your checking account, your checking account acts like a liquidity ratio for your personal budget. If your checking balance is more than twice your rent, ideally, you are in a good position financially to cover that expense without stress.

Current Ratio

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

a) Current Ratio Formula:

Current Assets

Current Ratio=

Current Liabilities

Ideal Ratio: 2:1

Interpretation: Indicates whether the company can cover short-term debts with current assets.

Detailed Explanation

The current ratio is calculated by dividing a company's current assets by its current liabilities. An ideal current ratio is 2:1, meaning that the company has twice as many current assets as current liabilities. This ratio provides insight into the company's short-term financial stability. If the ratio is below 1, it indicates that the company may have trouble meeting its short-term obligations, while a ratio significantly above 2 may suggest inefficiency in using its assets.

Examples & Analogies

Think of a student who has $200 in their bank account (current assets) and owes $100 in bills (current liabilities). Their current ratio is 2:1, indicating that they can comfortably pay their bills and still have money left over. If their bills were $150, their ratio would be 1.33:1, which is still acceptable but cautionary.

Quick Ratio (Acid Test Ratio)

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

b) Quick Ratio (Acid Test Ratio) Formula:

Current Assets – Inventory

Quick Ratio=

Current Liabilities

Ideal Ratio: 1:1

Interpretation: Stricter test of liquidity, excludes inventory.

Detailed Explanation

The quick ratio, also known as the acid-test ratio, is a more stringent measure of liquidity than the current ratio. It excludes inventory from current assets because inventory is not as liquid as cash or receivables. The formula is the difference between current assets and inventory, divided by current liabilities. An ideal quick ratio is 1:1, suggesting that the company can meet its short-term obligations without relying on the sale of its inventory.

Examples & Analogies

Consider a business that has $100,000 in current assets, but $60,000 of that is tied up in inventory. If their current liabilities are $40,000, their quick ratio would be: ($100,000 - $60,000) / $40,000 = 1.0. This indicates they can pay off their liabilities without having to sell inventory, which might take time.

Key Concepts

-

Current Ratio: A measure calculated by dividing current assets by current liabilities, with an ideal value of 2:1.

-

Quick Ratio: A refined measure of liquidity that excludes inventory from current assets, with an ideal value of 1:1.

Examples & Applications

If a company has $100,000 in current assets and $50,000 in current liabilities, its current ratio is 2:1, indicating strong liquidity.

A tech startup with current assets of $80,000 excluding inventory of $20,000 and current liabilities of $60,000 has a quick ratio of 1:1.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To cover the debts we should know, Current Ratio shows if money will flow.

Stories

Imagine a tech startup waiting to pay bills. They check their cash, and count paid invoices, which assure them they have the funds with current assets exceeding their liabilities.

Memory Tools

Cicero's Control: Current Is Cover, Quick Is Swift.

Acronyms

COW for Current Ratio

Current - Over - Wages to remember that it’s about covering expenses.

Flash Cards

Reference links

Supplementary resources to enhance your learning experience.