Profitability Ratios

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Gross Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we're going to discuss profitability ratios, starting with the Gross Profit Ratio. This ratio helps us understand how much profit a company retains from its sales after deducting the cost of goods sold.

How do we calculate the Gross Profit Ratio again?

Great question! The formula is Gross Profit divided by Net Sales, multiplied by 100. It's often expressed as a percentage.

What does a high Gross Profit Ratio indicate?

It generally indicates good efficiency in production and strong pricing power. To help you remember, think of 'G' in 'Gross' as 'Good profitability in production.'

So, is it a bad sign if the Gross Profit Ratio is low?

Not necessarily bad, but it may suggest issues with production efficiency or pricing strategies. Key takeaway: always analyze it in context with other metrics.

Could competition affect this ratio?

Absolutely! Increased competition can lead to lower prices, which may affect the Gross Profit Ratio. Let’s summarize: Gross Profit Ratio measures production efficiency and pricing power.

Net Profit Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let's move on to the Net Profit Ratio, which is crucial for understanding a company's overall profitability.

How does this ratio differ from the Gross Profit Ratio?

The Net Profit Ratio considers all expenses, including operating and non-operating costs. It's calculated as Net Profit divided by Net Sales, multiplied by 100.

What does a low Net Profit Ratio mean?

It could indicate high expenses or inefficiencies. But remember, it’s important to compare it against industry benchmarks for proper context.

Can you give an example of how this might look in real life?

Sure! A tech startup may report high sales but also high development costs. Their Net Profit Ratio might be lower than expected, signalling caution for potential investors.

So it's not just about sales?

Exactly! It's a holistic view of profitability. Remember, a high Net Profit Ratio indicates strong overall profitability.

Return on Capital Employed (ROCE)

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's discuss Return on Capital Employed, or ROCE. This ratio is essential for assessing how effectively a company uses its capital.

How is ROCE calculated?

It's calculated as EBIT divided by Capital Employed, multiplied by 100. This tells us how much profit the company generates for each dollar of capital.

What does it mean if the ROCE is increasing?

An increasing ROCE indicates improved efficiency in generating profits from capital. It shows better management of resources.

Can high ROCE be misleading?

Yes, it can. If the capital base is very low, it might skew the significance of the ratio. Always use ROCE with other metrics to get a complete picture.

What industries should focus more on ROCE?

Capital-intensive industries, like manufacturing or utilities, should closely monitor ROCE to ensure growth remains viable. Key takeaway here: ROCE helps gauge capital efficiency.

Return on Equity (ROE)

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let's look at Return on Equity, or ROE. This ratio is crucial for shareholders as it indicates how well their equity investments are being used.

How do we calculate ROE?

ROE is calculated as Net Income divided by Shareholders’ Equity, multiplied by 100. This shows the percentage return on investor funds.

What does a high ROE signify?

A high ROE means the company is efficiently using shareholders' funds to generate profit. However, be cautious; a very high ROE might indicate too much debt.

Can we compare ROE across different industries?

Not directly. Different industries have varying capital structures. Always compare ROE within the same industry for relevance.

What’s the key takeaway about ROE?

ROE is vital for investors to gauge profitability related to their investments. Always assess it in correlation with other financial metrics.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section details various profitability ratios, including the Gross Profit Ratio, Net Profit Ratio, Return on Capital Employed (ROCE), and Return on Equity (ROE). Each ratio measures a different aspect of how efficiently a firm generates profits relative to its revenue, assets, or equity, which is crucial for stakeholders to evaluate financial health.

Detailed

Profitability Ratios

Profitability ratios are metrics that assess a company's ability to generate earnings relative to its revenue, assets, or equity. This section outlines several key profitability ratios:

1. Gross Profit Ratio

Formula:

\[ \text{Gross Profit Ratio} = \left( \frac{\text{Gross Profit}}{\text{Net Sales}} \right) \times 100 \]

- Interpretation: This ratio reflects the efficiency of production or sourcing processes, highlighting pricing power and cost control.

2. Net Profit Ratio

Formula:

\[ \text{Net Profit Ratio} = \left( \frac{\text{Net Profit}}{\text{Net Sales}} \right) \times 100 \]

- Interpretation: A crucial indicator that captures overall profitability after all expenses, enabling comparisons across time or against competitors.

3. Return on Capital Employed (ROCE)

Formula:

\[ \text{ROCE} = \left( \frac{\text{EBIT}}{\text{Capital Employed}} \right) \times 100 \]

- Interpretation: This ratio measures the efficiency and profitability relative to the capital employed in the business, providing insights into how well a company is generating profits from its capital resources.

4. Return on Equity (ROE)

Formula:

\[ \text{ROE} = \left( \frac{\text{Net Income}}{\text{Shareholders' Equity}} \right) \times 100 \]

- Interpretation: It indicates how much profit a company generates with the money shareholders have invested, reflecting shareholders' return on their investment.

Understanding these ratios provides stakeholders, including investors and management, with essential tools to evaluate financial performance and make informed decisions regarding investments and operational strategies.

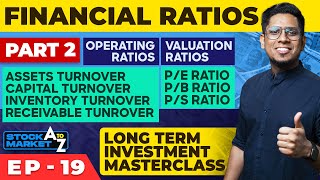

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Overview of Profitability Ratios

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These assess a firm’s ability to generate earnings relative to revenue, assets, or equity.

Detailed Explanation

Profitability ratios are essential financial metrics that help evaluate how effectively a company generates profit from its resources. They provide insights into how well the business is performing financially by examining the relationship between earnings and other financial figures such as revenue, assets, or equity.

Examples & Analogies

Think of a bakery that sells cakes. If the bakery spends a lot on ingredients and labor but sells each cake for very little, it might not be making enough profit. Profitability ratios help the bakery owner assess whether they need to adjust prices or reduce costs to improve profitability.

Gross Profit Ratio

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

a) Gross Profit Ratio Formula:

Gross Profit

----------- × 100

Net Sales

Interpretation: Reflects efficiency in production or sourcing.

Detailed Explanation

The Gross Profit Ratio is calculated by dividing the gross profit by net sales and then multiplying by 100 to express it as a percentage. This ratio indicates the percentage of revenue that exceeds the direct costs of producing goods or providing services. A higher gross profit ratio signifies that a company is efficiently managing its production costs and sourcing its materials.

Examples & Analogies

Imagine a clothing store that has sales of $100,000 and a cost of goods sold of $60,000. Its gross profit would be $40,000, giving it a gross profit ratio of 40%. This means 40% of its revenue is profit after accounting for the costs of items sold, allowing the store to cover other expenses like rent and salaries.

Net Profit Ratio

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

b) Net Profit Ratio Formula:

Net Profit

----------- × 100

Net Sales

Interpretation: Indicates overall profitability after all expenses.

Detailed Explanation

The Net Profit Ratio measures the overall profitability of a company by dividing net profit by net sales, expressed as a percentage. This ratio includes all expenses and costs, providing a comprehensive view of how much profit remains after paying all operational and non-operational costs. It is crucial for understanding the company’s actual profitability.

Examples & Analogies

Consider a restaurant with total sales of $200,000 and total expenses (including food costs, labor, rent, etc.) of $180,000. The net profit would be $20,000, leading to a net profit ratio of 10%. This figure shows how much profit the restaurant actually makes after covering all its costs, giving potential investors insight into its financial health.

Return on Capital Employed (ROCE)

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

c) Return on Capital Employed (ROCE) Formula:

EBIT

----------- × 100

Capital Employed

Interpretation: Efficiency in using capital to generate profits.

Detailed Explanation

ROCE measures a company’s profitability and efficiency in using its capital to generate earnings before interest and taxes (EBIT). It is calculated by dividing EBIT by capital employed, with the result expressed as a percentage. A higher ROCE indicates a more efficient use of capital, which is particularly important for investors when assessing how well a company utilizes its funds to generate profits.

Examples & Analogies

Think about a startup that has invested $1,000,000 in various projects and generates an EBIT of $250,000. The ROCE would be 25%, meaning the company earns 25 cents for every dollar of capital employed. This metric helps potential investors or partners understand if the startup is making good use of its funds.

Return on Equity (ROE)

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

d) Return on Equity (ROE) Formula:

Net Income

----------- × 100

Shareholders’ Equity

Interpretation: Profit earned on shareholders’ funds.

Detailed Explanation

ROE indicates how effectively a company generates profit from its shareholders' equity. By dividing net income by shareholders’ equity and multiplying by 100, it shows how much profit is generated for each dollar invested by shareholders. A higher ROE is generally favorable, indicating that the company is good at turning equity into profits.

Examples & Analogies

Imagine an angel investor putting in $100,000 into a tech startup that eventually makes a net income of $30,000. The ROE would be 30%. This means the investor’s funds are generating a strong return, illustrating the startup's ability to reward its investors effectively.

Key Concepts

-

Gross Profit Ratio: Measures production efficiency by showing the percentage of revenue retained after the cost of goods sold.

-

Net Profit Ratio: Indicates the overall profitability after accounting for all expenses, essential for evaluating financial health.

-

Return on Capital Employed (ROCE): Assesses how effectively a company generates profits from its capital investments.

-

Return on Equity (ROE): Reflects the profitability shareholders can expect from their invested capital.

Examples & Applications

If a company has a Gross Profit of $300,000 and Net Sales of $1,000,000, the Gross Profit Ratio is (300,000 / 1,000,000) * 100 = 30%.

A company reporting a Net Income of $200,000 and Shareholders’ Equity of $1,000,000 will have an ROE of (200,000 / 1,000,000) * 100 = 20%.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Profit to show, sales that flow; Gross comes first, but Net’s the glow.

Stories

Imagine a baker who sells cakes. The more cakes he sells, the better his Gross Profit. But if he spends too much on ingredients, his Net Profit tells the true story of his business.

Memory Tools

For ROCE, think: 'Return on Capital, Full Efficiency!' Watch your profit per invested dollar.

Acronyms

ROE = Really Outstanding Earnings for every equity dollar.

Flash Cards

Glossary

- Gross Profit Ratio

A profitability ratio that reflects the efficiency in production or sourcing, calculated as Gross Profit divided by Net Sales.

- Net Profit Ratio

Measures the overall profitability of a company after all expenses have been deducted from net sales.

- Return on Capital Employed (ROCE)

A metric assessing a company’s efficiency in generating profits from its capital, calculated as EBIT divided by Capital Employed.

- Return on Equity (ROE)

Indicates how much profit a company generates with shareholders’ equity, calculated as Net Income divided by Shareholders' Equity.

Reference links

Supplementary resources to enhance your learning experience.