Return on Equity (ROE)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to ROE

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're diving into the concept of Return on Equity, or ROE. This ratio measures how well a company utilizes shareholders' equity to generate profit. Can anyone tell me the formula for calculating ROE?

Isn’t it Net Income divided by Shareholders' Equity?

Exactly! So, we express it as ROE = (Net Income / Shareholders' Equity) x 100. This helps us understand how much profit is generated for each dollar of equity. Why is this important?

Because investors want to know if their investments are yielding returns!

Right! A higher ROE indicates the company is efficient in generating profit. Let’s remember this with the acronym ‘ROE’ - Return On Equity. It emphasizes that equity financing directly correlates to returns.

Interpreting ROE

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know how to calculate ROE, let’s discuss what it means. A high ROE suggests effective management and profitable use of equity. But what about a low ROE?

Isn't that a warning sign? It could mean the company is less efficient or has used too much debt.

Good observation! A low ROE might indicate potential issues in profitability or excessive risk. It's essential, therefore, to compare ROE with industry standards for a clearer picture.

So, if a company’s ROE is lower than its competitors, should investors be concerned?

Yes, indeed! Always assess ROE within industry context. That’s a key point to remember.

ROE in Tech Companies

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s apply our understanding of ROE to tech companies. Why might this ratio be particularly significant in the tech sector?

Tech companies often require significant capital investment. Their ROE can show how well they're turning that investment into profit.

Exactly! Especially in emerging tech startups, a healthy ROE can indicate strong business viability to investors. What’s another factor tech companies should consider?

Other financial ratios that can complement ROE, like profitability and liquidity ratios?

Correct! Combining ROE with other metrics gives a more rounded view of a company’s financial health.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Return on Equity (ROE) is a vital profitability ratio that assesses how effectively a company uses shareholders' equity to generate profit. It highlights the profit earned per dollar of equity, helping stakeholders evaluate the financial performance and management effectiveness of a business.

Detailed

Return on Equity (ROE)

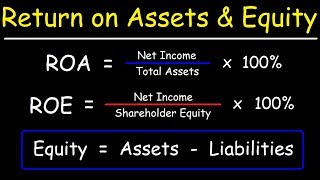

Return on Equity (ROE) is a critical financial ratio used to evaluate a company's profitability in relation to shareholders' equity. The formula for calculating ROE is:

Formula:

\[ ROE = \frac{Net \ Income}{Shareholders' \ Equity} \times 100 \]

This ratio provides insight into how well a company is using the equity invested by its shareholders to produce profits. A higher ROE indicates that the company is more efficient at converting investment into profit, making it an important indicator for investors looking for strong returns.

ROE is particularly significant when comparing companies within the same industry, as it highlights not just profitability but also the effectiveness of management decisions concerning equity financing. Understanding ROE is essential for stakeholders, especially for BTech CSE students interested in assessing tech firms’ financial health.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Return on Equity (ROE) Formula

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

ROE = \( \frac{\text{Net Income}}{\text{Shareholders' Equity}} \times 100 \)

Detailed Explanation

The formula for Return on Equity (ROE) is calculated by dividing net income by shareholders' equity and then multiplying by 100 to express it as a percentage. Net income is the profit a company makes after all expenses and taxes have been deducted. Shareholders' equity is the total value of the shareholders' interest in the company.

Examples & Analogies

Think of ROE like a garden. The net income represents the fruits you harvest from your garden (the actual earnings), while shareholders' equity is like the effort and resources you put into cultivating it (the soil, seeds, and watering). A high ROE means you're getting a lot of fruits relative to the effort and resources you've invested, which signifies a productive garden.

Interpretation of ROE

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Interpretation: Profit earned on shareholders’ funds.

Detailed Explanation

The Return on Equity quantifies how effectively a company is using shareholders' funds to generate profits. A higher ROE indicates that a company is effectively utilizing the investors' money to drive profit growth, while a low ROE might signal inefficiency or underperformance. Investors often seek companies with a higher ROE as it suggests better management and higher returns on their investments.

Examples & Analogies

Imagine you lend money to a friend to start a lemonade stand. If your friend uses your money wisely and makes a good profit, the return you get from your loan is like a high ROE. Conversely, if they struggle to sell lemonade and generate little profit, that would represent a low ROE, indicating they’re not using your money efficiently. You'd be more inclined to support the friend with the successful stand since your returns are better.

Key Concepts

-

Return on Equity (ROE): A measure of profitability calculated as Net Income divided by Shareholders' Equity, expressed as a percentage.

-

High ROE indicates effective management and efficient use of equity.

-

Low ROE may signal poor financial performance or excessive reliance on debt.

-

Comparative analysis with industry peers enhances the valuation of ROE.

Examples & Applications

If a company has a net income of $500,000 and shareholders' equity of $2,000,000, the ROE would be (500,000 / 2,000,000) x 100 = 25%.

A tech startup showcasing a high ROE compared to industry rivals can attract more investors.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To find your ROE, just take a glance, Net Income over equity gives you your chance!

Stories

Imagine a gardener investing money in a garden. The flowers blooming beautifully represent profits earned from his investment; that's how ROE shows the growth from shareholders' equity.

Memory Tools

Remember 'R.O.E.' - return on equity: Really Over Earnings - it says how well you earn from equity!

Acronyms

ROE

= Returns

= On

= Equity; this highlights the ratio’s focus.

Flash Cards

Glossary

- Return on Equity (ROE)

A financial ratio that measures the ability of a company to generate profit from its shareholders' equity.

- Net Income

The total profit of a company after all expenses and taxes have been deducted.

- Shareholders' Equity

The residual interest in the assets of the company after deducting liabilities.

Reference links

Supplementary resources to enhance your learning experience.