Solvency Ratios (Leverage Ratios)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Concept of Solvency Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're delving into solvency ratios, also known as leverage ratios, which gauge a firm's ability to meet long-term obligations. Why do you think these ratios are pivotal for investors?

I think they help investors know if the company can survive its debts and risks.

Exactly! Solvency ratios give insights into the financial stability of a company. What's one of the most common solvency ratios?

The Debt-to-Equity ratio, right?

That's correct! This ratio compares a company's total debt to shareholder equity. A higher ratio indicates higher leverage. Remember, debt can amplify both returns and risks.

How do we calculate that?

Great question! The formula is Total Debt divided by Shareholders' Equity. Let’s explore this more with an example.

Exploring the Debt-to-Equity Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s calculate the Debt-to-Equity ratio for a company with total debt of $400,000 and shareholder equity of $200,000. What do you think we get?

I think that would be 2!

Exactly! A ratio of 2 means the company has twice as much debt as equity. What does that tell us about their financial risk?

They might be more vulnerable in downturns because they rely on debt.

Spot on! High debt can be risky. Now, what is another key solvency ratio?

The Interest Coverage ratio?

Correct! This helps us understand how well a company can cover its interest expenses.

Understanding the Interest Coverage Ratio

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss the Interest Coverage Ratio. This ratio is calculated using Earnings Before Interest and Taxes (EBIT) divided by Interest Expense. Why is this ratio critical?

It shows how easily a company can pay interest on its debts.

Exactly! A higher ratio indicates better financial health. If a company has an EBIT of $120,000 and an interest expense of $30,000, what would the ratio be?

That would be 4!

Right! A ratio of 4 means the company earns 4 times its interest expense, showcasing a strong ability to settle its debts. Now, let’s summarize key takeaways.

To recap, solvency ratios help you gauge the financial risk associated with a business. The Debt-to-Equity ratio shows how much leverage a company has, while the Interest Coverage ratio assesses its ability to cover interest payments. These insights are crucial for making informed financial decisions!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section focuses on solvency ratios, including the Debt-to-Equity ratio and Interest Coverage ratio, which indicate a company's long-term financial health. Understanding these ratios is crucial for stakeholders evaluating financial risk and making informed funding decisions.

Detailed

Solvency Ratios (Leverage Ratios)

Solvency ratios, also known as leverage ratios, measure a firm's capability to meet its long-term obligations. Understanding these ratios is essential for investors, creditors, and management to make informed decisions regarding the company's financial health and risk profile.

Key Ratios:

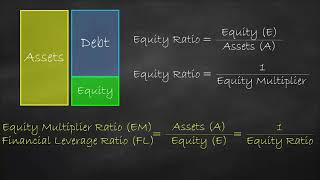

1. Debt-to-Equity Ratio

- Formula:

\[ \text{Debt-to-Equity Ratio} = \frac{\text{Total Debt}}{\text{Shareholders' Equity}} \]

- Interpretation: A high ratio implies a larger proportion of debt in financing, indicating financial risk due to high leverage.

2. Interest Coverage Ratio

- Formula:

\[ \text{Interest Coverage Ratio} = \frac{\text{EBIT}}{\text{Interest Expense}} \]

- Interpretation: This ratio measures the ease with which a firm can pay interest on its outstanding debt. A higher ratio signals better ability to cover interest payments and thus indicates lower risk.

Importance in Financial Analysis:

Solvency ratios are crucial in assessing the financial stability of an organization, especially for investors and creditors. They inform risk assessment and investment decisions, guiding stakeholders in strategic planning and funding negotiations.

Youtube Videos

![#3 Ratio Analysis [Solvency Ratios] ~ Concept behind formation of a Formula](https://img.youtube.com/vi/eYxJVxVskoc/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Solvency Ratios

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These indicate a firm’s ability to meet long-term obligations.

Detailed Explanation

Solvency ratios, also known as leverage ratios, help to assess a company's financial stability and its capacity to fulfill its long-term liabilities. Analyzing these ratios is crucial for understanding the overall financial health of a business, especially in determining whether it can sustain operations over the long term without facing financial distress.

Examples & Analogies

Think of solvency ratios as a measure of a person’s ability to pay off debts over time. Just like a person needs to ensure they can cover their mortgage and car loans consistently, companies also need to prove to lenders and investors that they can pay off their long-term debts.

Debt-to-Equity Ratio

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

a) Debt-to-Equity Ratio Formula:

Total Debt

Debt-Equity Ratio=

Shareholders’ Equity

Interpretation: High ratio signals more debt financing, possibly more financial risk.

Detailed Explanation

The Debt-to-Equity Ratio compares a company's total debt to its shareholders' equity. A higher ratio implies that the company is using a significant amount of debt to finance its operations compared to equity. While debt can be beneficial for leveraging investment, too much debt can increase financial risk, especially if earnings fall and the company struggles to meet its obligations.

Examples & Analogies

Consider this analogy: if a friend takes out a lot of loans (debt) to invest in starting a new business, their debt-to-equity ratio is similar to assessing how much of their money (equity) versus borrowed money is funding the venture. If they have a high loan amount compared to their own savings, it may indicate higher financial risk.

Interest Coverage Ratio

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

b) Interest Coverage Ratio Formula:

EBIT

Interest Coverage Ratio=

Interest Expense

Interpretation: Measures how easily a firm can pay interest on outstanding debt.

Detailed Explanation

The Interest Coverage Ratio evaluates a company's ability to pay interest on its debt. It is calculated by dividing Earnings Before Interest and Taxes (EBIT) by the interest expenses. A higher ratio indicates that a company can comfortably meet its interest obligations from its earnings. Conversely, a lower ratio might indicate potential financial trouble, highlighting that the company may struggle to pay its interest commitments.

Examples & Analogies

Imagine a monthly budget where you need to ensure that your income sufficiently covers your bills. The Interest Coverage Ratio is like checking if your monthly income can easily cover the monthly bills you have. If your income is much higher than your bills, you have a good buffer; if not, you may need to reconsider your expenses or income.

Key Concepts

-

Debt-to-Equity Ratio: This ratio helps assess the financial leverage of a company and the relative proportion of debt versus equity.

-

Interest Coverage Ratio: This measures the firm's capability of meeting interest payments on its outstanding debt.

Examples & Applications

Example 1: A firm with total debt of $300,000 and shareholder equity of $150,000 has a Debt-to-Equity ratio of 2:1, indicating higher reliance on debt financing.

Example 2: A firm's EBIT of $80,000 against an interest expense of $20,000 results in an Interest Coverage ratio of 4, signalizing a strong ability to meet interest obligations.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Debt and equity, side by side, the ratio tells where risks reside.

Stories

Imagine a tall building (company) financed by both loans (debt) and investors (equity). The balance keeps it standing strong, but too much debt might lead it wrong.

Memory Tools

D-E Ratio: Don’t Economize; reveal your debt!

Acronyms

D/E

Debt Over Equity.

Flash Cards

Reference links

Supplementary resources to enhance your learning experience.